A Behind The Scenes Look at Debt Resolution

Debt resolution is a great option for many people. However, even after you’ve decided to take the plunge and resolve your debt through a program, you may feel unclear about what to expect.

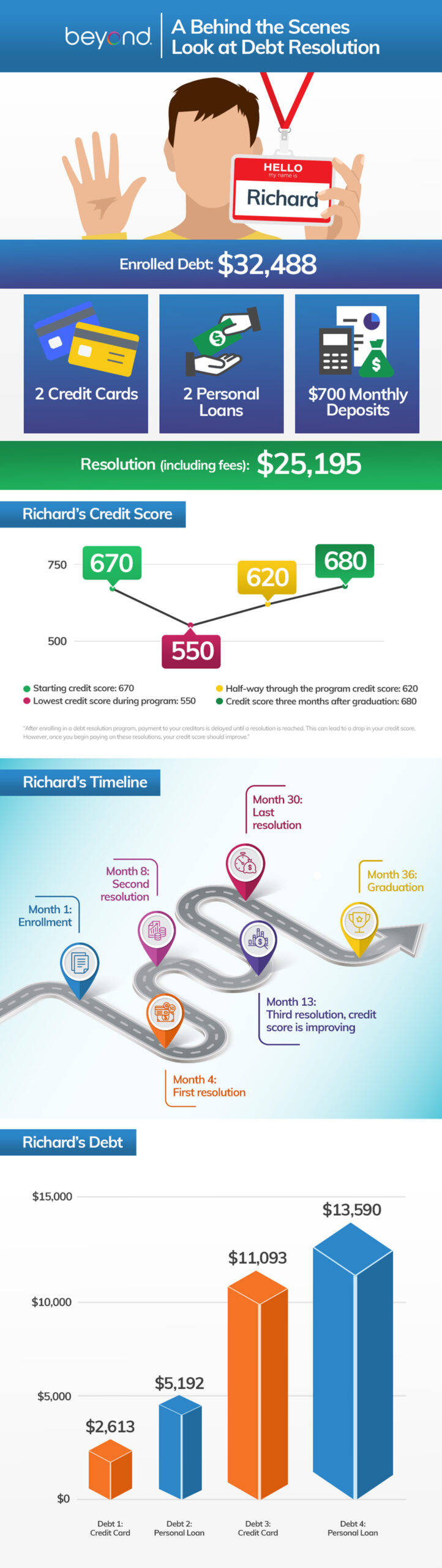

We’ve taken our experience helping thousands of people get out of debt and created a behind-the-scenes look at our program at various points in the process. In this blog, you’ll tag along with our client, Richard, as he enrolls his debt, makes monthly deposits and relaxes while his Beyond Finance representative negotiates resolutions with his creditors.

While Richard isn’t a real person, we’ve created his profile and experience based on our real clients’ data. His story reflects a representative client experience in the Beyond Finance debt resolution program.

Meet Our Client!

Richard came to Beyond Finance with $32,488 in debt because he was ready for a change. Even though he had a steady job, followed a budget and was responsible with his money, he couldn’t get ahead of his high-interest debt. For years he had been paying thousands of dollars in interest and fees and was barely chipping away at his principal balances.

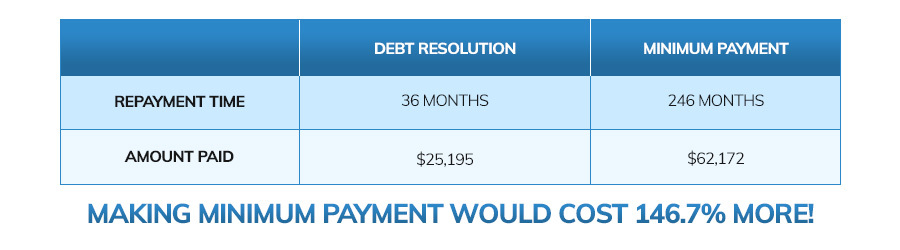

Before Richard enrolled his debt with Beyond Finance, his minimum monthly payments were around$1,300. If he continued to pay only his monthly minimums, it could have taken him more than 20 years and $62,172 to pay off his debts

Our debt resolution program helped him enroll four accounts and resolve his debt for $25,195—much less than he would have paid if he had continued paying the debt off on his own or chosen an alternative like a debt consolidation loan.

Choosing debt resolution allowed Richard to pay-off his debt in 36 months and save money that brought him closer to his dream of homeownership.

Month 1: Getting off To a Good Start

Our most successful clients get off to a good start by completing a few tasks outlined in our Welcome Kit. After completing his enrollment, we walked Richard through the to-do list and answered his questions to make sure he knew exactly what to expect.

All of these tasks are necessary, but we like to emphasize how important it is to delay payments to your creditors and instead start making monthly deposits into your Dedicated Account. The money you save here is essential to powering your program and, with your approval, will be used for payments to creditors and your program fees.

To Do’s

☐ Decide to stop paying your creditors until a resolution is reached

☐ Stop using credit cards enrolled in the program

☐ Mark calendar with Dedicated Account deposit dates

☐ Store our number in your phone, so you know we are calling

☐ Block calls relating to your enrolled debt

Month 4: The First Resolution

After the enrollment process is over, our clients get to relax while we handle their debt negotiations. As a client, your job is to make your monthly deposits on time while we do the rest! That includes deciding which enrolled accounts to resolve first, keeping an organized record of every conversation we have with your creditors, negotiating offers, and getting you the most significant reduction possible on your debt.

Most of our clients see a drop in their credit score as soon as they delay payment to their creditors and begin building their Dedicated Account. This empowers them to take control of their money and ensure that it fuels their debt resolution rather than continue to be eaten up by interest and fees.

Did you know?

Your payment history accounts for about 35% of your overall score, and our program helps you with the other 65%, including your debt-to-income ratio!

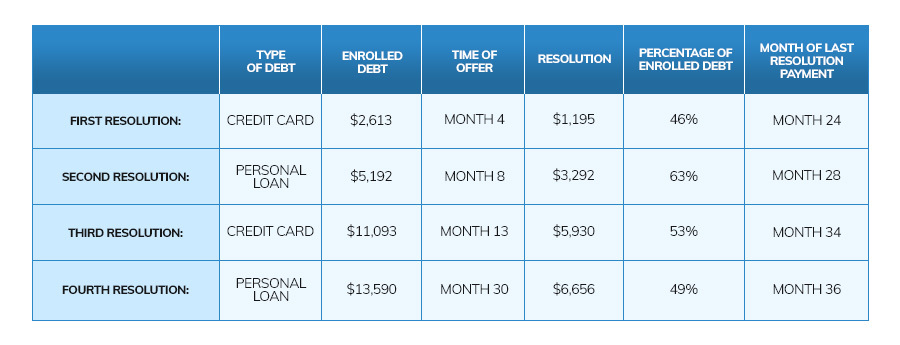

Four months after starting the program, we got Richard his first offer. We negotiated with Chase to resolve a $2,613 credit card balance for $1,195 which means he paid 46% of what he originally owed.

Month 18: Credit Score is Bouncing Back!

By month 18, Richard is halfway through the program with three successful resolutions. His debt to income ratio lowered, which raised his credit score from 550 to 620. He was happy with his progress, and having more money on hand each month helped him start planning for the future, including setting aside money for a downpayment for a house he plans to buy after he completes the program.

Month 24: One More Resolution To Go

Two years into the program, almost all of Richard’s creditors have agreed to resolutions, and regular payments on each resolution are being dispersed from his Dedicated Account. He has already seen great improvements to his credit health and has noticed that he is less stressed about money than he used to be. Making regular deposits into his Dedicated Account has given him confidence in his ability to manage debt in the future.

Month 30: The Last Resolution

Once a resolution offer is approved, it typically involves agreeing to a payment plan. For example, Richard’s last resolution resolves a $13,590 account for $6,656, which will be paid to the creditor from the Dedicated Account in 18 payments of $370.

Richard doesn’t have to manage those payments because his Beyond Finance representative does it for him.

Month 36: Graduation

By the time Richard reaches his graduation, he has had three years to build his confidence, practice good financial habits and plan for the future. Most of our clients are excited about graduation but feel that they have reaped the rewards long before their graduation is official.

When you complete your debt resolution program, you don’t have to worry about being surprised with a bill from Beyond Finance. That is because our program fees are success-based and paid gradually throughout the program. Our fee is assessed as a percentage of each enrolled debt and is paid from your Dedicated Account when a resolution has been reached for that debt.

You’ll never have to put up money beyond your monthly deposit to cover our service fees.

Making Debt Resolution Work for You

Everyone’s experience with debt resolution will be unique, but we know that our most successful clients do these three things:

- Make regular deposits

- Practice good financial habits

- Communicate questions and concerns with their Beyond Finance Representative

We are here to help and be a resource for you every step of the way, ensuring that your debt resolution journey is successful.