A Sneak Peek at Real Client Resolution Offers

When many clients first begin their Beyond Finance program, they are understandably cautious. “What will results look like?” is one of the many questions our Client Success team fields when folks first begin their program.

It can be daunting waiting 3–6 months for that first resolution offer to arrive, but many of our clients tell us that once it does, they’re able to breathe easier seeing firsthand that the process is working.

Offers can come in a few different forms. Many times, after the negotiations process, creditors contact Beyond Finance directly and we reach out to you by phone, email, and through your Dashboard to get your approval. But sometimes creditors will send clients the resolution offer with the newly negotiated-down balance directly!

Check out some these real offer letters to see what your upcoming offers might look like …

Resolution Offer #1: Chase

In this case, the client was offered two different options of how to pay their reduced balance. Our team would have taken into consideration how much the client had in their Dedicated Account when negotiating with Chase.

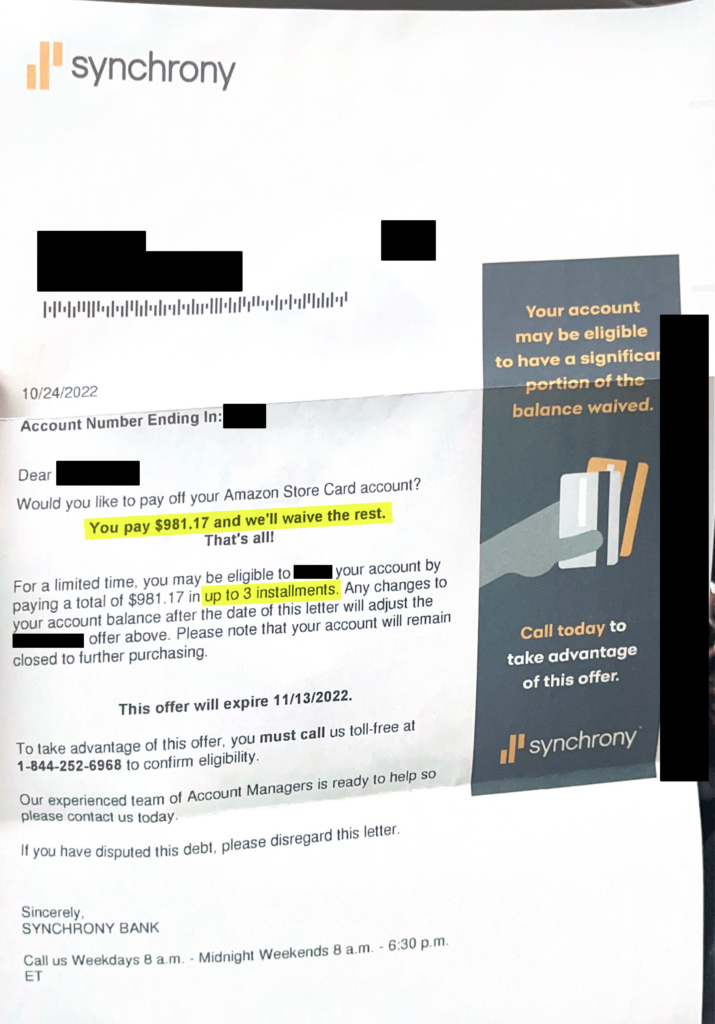

Resolution Offer #2: Synchrony

This client was offered the chance to pay off their reduced balance in 3 installments. This is relatively standard — our negotiations team is always keeping an eye on your Dedicated Account and the kind of resolutions you’ll be able to afford at any point in time.

Not every client will receive this type of offer letter in the mail — you’ll often receive a call directly from Beyond Finance letting you know the good news and asking for your approval! But we still wanted to give you a glimpse into the types of offers you can expect to receive once you’ve built up enough funds in your Dedicated Account and enough time has passed. Both these things give our negotiations team the leverage they need to reach great resolutions for you.

And remember! If you’ve been notified about a resolution offer, let us know if you approve of it ASAP! Offers always have a deadline and we don’t want you missing out on these opportunities.

Not yet enrolled but interested in getting resolutions like this? Speak to a Consolidation Specialist as soon as possible to find out how much you could save.