How a Lower Monthly Payment Can Transform Your Finances

When you enroll in debt resolution, you are starting a holistic program that will help you get out of debt faster and for less than you owe. One immediate benefit is a consolidated and reduced monthly payment.

Our program consolidates debt payments into one that could reduce your monthly obligation by 50% or more. These savings could have an immediate effect on your budget. Learn more about how a lower monthly payment can transform your finances.

You Could Lower Your Monthly Payment by 50%

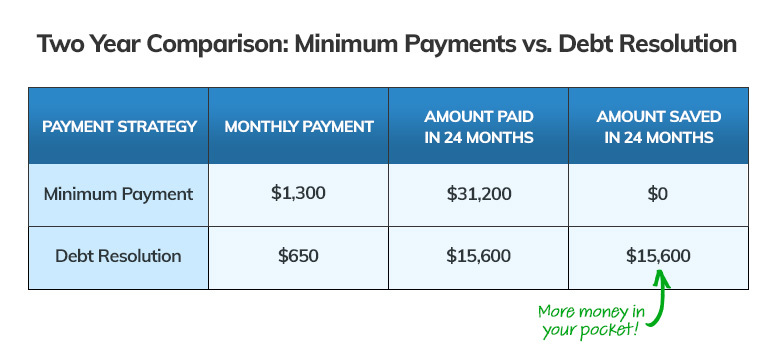

Our debt resolution program can combine and lower your current monthly payment. For example, if you were making minimum payments of $1,300 a month we could lower your payment to just $650.

Over two years, you’d save $15,600 and that’s just the beginning. Our debt resolution program helps neutralize interest and fees. Once you agree to the new terms we negotiate on your behalf your debt will stop growing. Unlike minimum payments, debt resolution helps stop the debt cycle so you can get out of debt faster.

A lower monthly payment not only keeps more money in your pocket but fuels your resolutions. Most of our clients finish their resolution program in 12 to 48 months.

How would having hundreds of dollars more every month transform your finances?

1. Have More Money for Groceries and Other Essentials

When you are overwhelmed by debt, you can run out of places to cut back on spending. You may find yourself questioning what you spend on basic necessities like groceries. This is incredibly stressful and can lead you to make sacrifices that lower your quality of life.

You should never have to choose between paying your debt and feeding your family! Enrolling in debt resolution can cut your monthly payments in half, and free up hundreds of dollars in your budget, making it easier for you to meet your everyday needs.

2. Catch Up on Other Accounts

Your enrolled debts may not be the only accounts that are causing you concern. Having more money in your pocket every month can help you stay on top of utility bills, student loans, and more.

Ensuring that you are current with all your financial obligations is a big step toward overall financial wellness.

3. Start Saving for an Emergency Fund or Special Purchase

When debt is out of control, saving can seem impossible. Having more money on hand each month can help you create an emergency fund or save for a special purpose.

Start with a small goal and work your way up. We recommend having at least $1,000 in your emergency fund. Once you’ve met that goal, try to save three to six months’ worth of living expenses. This can take a while, but it’s worth it.

An emergency fund can come to the rescue when you experience unexpected needs like a car or home repair, unemployment, or personal injury.

4. Invest Money To Grow It for Your Future

Saving money is great but investing it is better! It’s important to have cash on hand for short-term emergencies or special purposes, however, once you’ve met your short-term savings goals, it’s time to start investing.

When you save money on your monthly payment, you can put that extra cash into investment accounts that will help you build future wealth.

Consider this: money that sits in a savings account isn’t growing or is growing at a snail’s pace. According to a 2021 survey by Bankrate, the national average interest rate for savings accounts is 0.06%.

In an investment account, there is some risk but also reward. An annual ROI of approximately 7% or greater is considered good for stocks. Because this is an average, some years your return may be higher; some years, they may be lower. Using an investment app can help you get started and will let you choose your level of risk.

5. Lower Your Stress with Fewer Money Worries

Financial uncertainty is stressful and can have a lasting impact on both your financial and emotional well-being. According to Dr. Galen Buckwalter, “acute financial stress creates many of the same negative stressors as PTSD.”

Taking action to resolve your debt is a critical first step in breaking the cycle of acute financial stress. Debt resolution not only provides a holistic approach to debt but has immediate benefits, like lower monthly payments, that could reduce short-term money worries.

With hundreds of dollars more in your pocket every month, you can breathe a little easier and regain your confidence.

Debt Resolution Can Transform Your Finances

In addition to consolidating and lowering your monthly payment, debt resolution simplifies your approach to debt. During the program, you get to focus your attention on making a reduced monthly payment to your dedicated account, instead of managing and keeping track of multiple accounts.

While our debt experts work on a holistic strategy for all of your enrolled debts, you can relax and work on good habits that will improve your financial literacy and future creditworthiness.

Lower Your Monthly Payment and Take Control of Your Debt

Everyone’s experience with debt resolution will be unique, but we know that our successful clients:

- Could reduce monthly payments by 50% or more

- Get out of debt in 12 to 48 months

- Graduate with good financial habits

Our team is here to help and be a resource for you every step of ensuring that your debt resolution journey is a success.