Debt Resolution Timeline and Savings: What To Expect

When you’re beginning a debt resolution program, it can feel a little intimidating! If you’re like most Beyond Finance clients, you’re entering uncharted territory.

To help you understand what to expect, we’ve created an example client whose journey and savings reflects a typical Beyond Finance client’s. Keep in mind that your experience and timeline will be unique to you depending on your enrolled debt amounts, deposits, creditors, total debt, and more.

Follow along on the journey to learn how this client achieved $68,477 in savings and avoided 17 additional years of paying off debt!*

Walk in Our Client’s Footsteps

Imagine you were unexpectedly laid off and racked up $32,585 in credit card and loan debt before you found a new job.

Though you now have a steady income, you aren’t able to make a dent in your debt because you can only afford the minimum payments on your accounts. Almost all of your money is going to interest — not paying off your balance.

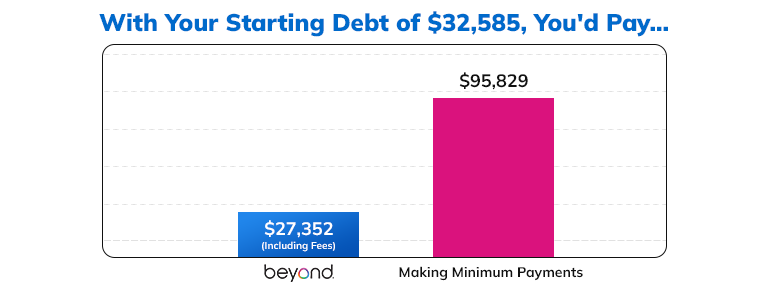

If you stayed on this path, it would take you at least 21 years and $95,829 to pay off the 32.5K debt.*

Perhaps you want to pay off your mortgage one day or build savings for your retirement. You realize you need to make a change for this to become a reality.

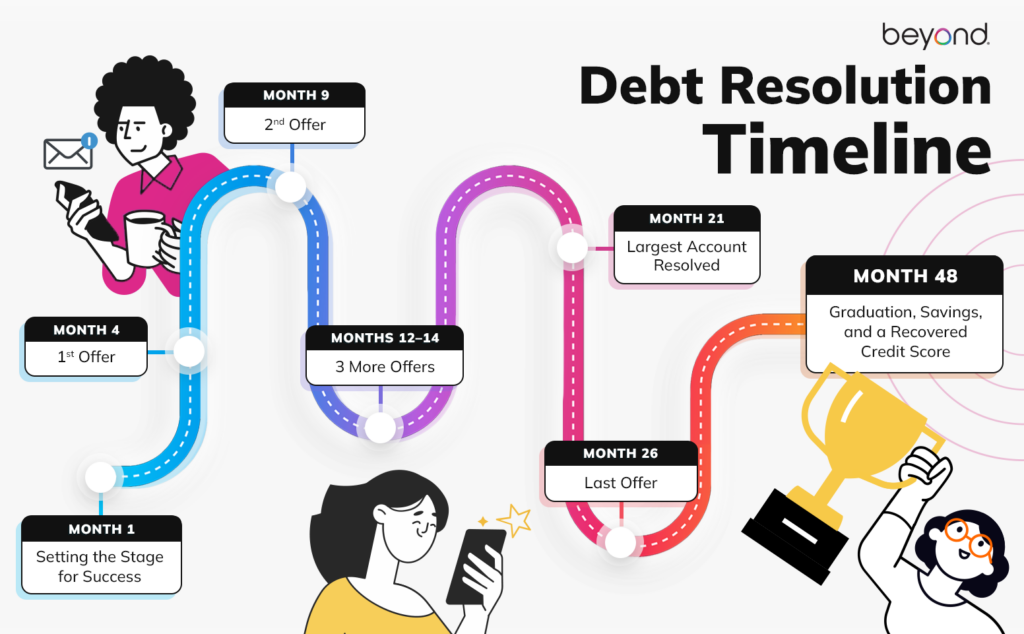

Month 1: Setting the Stage for Success

Our most successful clients take a series of important steps at the very start:

- Cancel autopay on enrolled accounts

- Stop using credit cards enrolled in the program

- Add Beyond Finance’s contact information

- Download and log into the Client Dashboard

- Avoid over-focusing on credit score

You do all of these, and you’re already seeing relief. Lowering your monthly payment from $1,075 to $645 has given you room to breathe and you have started funding a savings account.

Month 4: Your First Offer

Before you see your first Resolution Offer, you unfortunately have to deal with a ramping up of creditor calls and intimidation tactics. But you know that this is just the creditors giving their best shot to get you to go back to minimum payments first, before they agree to an offer.

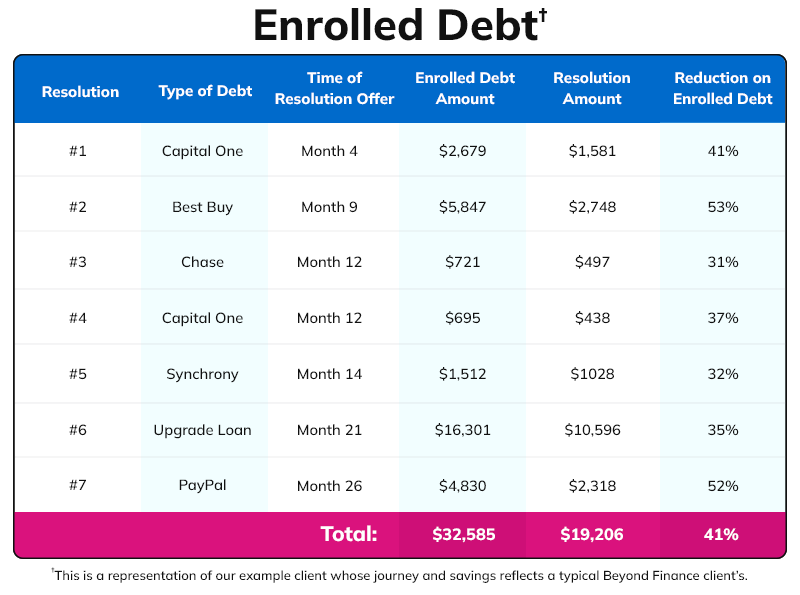

Clients typically see their first Resolution Offer within 3 to 6 months of enrollment. In your case, you finally get to see firsthand that the process works at the Month 4 point! Beyond Finance reaches out to let you know that your first creditor has made a Resolution Offer with a 41% reduction on the debt! Right away, you let our team know that you’ve accepted so you don’t miss the offer deadline.

Now some of your funds can go to gradually paying off that offer through a payment plan, while your remaining funds are kept in play to leverage more Resolution Offers.

Month 9: Further Progress

Your second account is larger than the first so it took a bit longer to reach a Resolution Offer. But the savings were worth the wait. For this enrolled debt of $5,847, you get an offer of $2,748 – a 53% reduction!

While our negotiations team always aims for at least a 50% debt reduction, each Resolution Offer will vary, some with less savings, some with more.

Month 12–14: Three More Resolution Offers

You receive two Resolution Offers in Month 12 and one more in Month 14!

Most of your deposits are now going towards your active offers, so you know you might have to wait a bit to see the next one, but you’re now confident you’re nearing the finish line.

Month 21: Your Largest Account Resolved

While some clients will have their largest account resolved earlier in their program, some will see it happen later down the line. Each person’s accounts will be addressed in a strategic order based on a number of different factors.

Occasionally, clients will experience a longer wait, or “quiet period,” between offers. Usually this happens when:

- Multiple Resolution Offers are being paid off

- More funds need to be built up in your Dedicated Account to negotiate a larger account

While you’ve had to practice some patience, at Month 21, your largest debt of $16,301 is resolved for $10,596!

Month 26: Final Resolution Offer

You didn’t have to wait too much longer for your last Resolution Offer to come through. You receive a 52% reduction on a $4,830 credit card debt, and now only owe your creditor $2,318.

At this point, you’re in a “set it and forget it” mode. Your deposits are doing the work for you and you continue to turn your focus towards enjoying life.

Month 48: Graduation, Savings, and a Recovered Credit Score

At Month 48, you graduate and you’re 100% debt-free.

Your Life-Changing Savings

By completing your Beyond Finance program, you’ve avoided the cycle of compounding interest that would have kept you in debt for over two decades and cost you at least $95,829.* This is a conservative estimate and assumes you never put any more charges on your credit cards after the initial ~$32.5K debt.

You saved $5,233 through debt reductions (including Beyond Finance’s fees) and another $63,244 by avoiding future compounding interest.

In total, you saved at least $68,477 and avoided 17 additional years of paying off debt.

Credit Score Recovery

Most clients will begin to see their credit score begin to recover 4 months into their program. You were no different.

While you focused on your priority — eliminating your debt — your credit score has been steadily recovering in the background. At graduation, you finally allow yourself to take a look and discover it is back around 650 — right where it was when you enrolled.

Now It’s Your Turn

Time to step out of this client’s shoes and into your own.

Remember that your experience and timeline will be unique to you! You may hit program milestones sooner or later than this example client, but the destination is the same.

You’re on a real path to a debt-free life with significant savings from reductions and saying “no” to that never-ending cycle of compounding interest.

A little advice from our team as you move forward:

- Stick to your deposit schedule as much as possible.

- If you want to speed up your graduation, deposit extra funds if and when you can.

- Be patient between offers — there may be quiet periods, but they’re on their way!

- Reach out to our Client Success team whenever you have concerns, questions, or just need support.

- Don’t beat yourself up about needing help. There are tens of thousands of other people in the program — all who deserve to escape that cycle of compounding interest, just like you.

Take it one step at a time, and give yourself the credit you deserve for being brave enough to take action towards a better future!

Not currently in a debt resolution program but interested in reducing and paying down your debts once and for all? Get a free consultation with a Consolidation Specialist and learn how much you can save.

*Based on cost and timeline to get out of debt making minimum payments on credit card debt for individuals with fair credit, an APR of 21%, and assumes a payment of 2.5% of the balance. Please note that, assuming the principal balance does not increase due to additional charges, fees, and interest, the required minimum monthly payment will decrease over time as additional minimum monthly payments are made and reduce the total balance.