Accredited Debt Relief – Navigate Debt Consolidation With Confidence

At Beyond Finance, we’re passionate about helping people get out of debt — and we couldn’t do it without our front-end brand, Accredited Debt Relief. Collectively, we work to help people regain financial control and build debt-free futures.

Get To Know Accredited Debt Relief

Accredited Debt Relief is a highly trusted and nationally recognized brand operated as a division of Beyond Finance.

While we are two sides of the same company, we help clients at different stages of their financial journey. The Accredited Debt Relief team helps clients find the best path forward, and the Beyond Finance team will step in if a solution with Beyond Finance is deemed the right fit. Together, we share a unified company mission: to help people take control of their debt.

Accredited Debt Relief’s team of Consolidation Specialists is known for giving clear and compassionate guidance that helps people make confident decisions for their debt. For over 13 years they’ve matched people with personalized debt consolidation options.

Fast Facts About Accredited Debt Relief

Accredited Debt Relief has helped 700k+ people, paying off $2 billion+ client debt in the process.

How We Work Together to Help People in Debt

Finding the right debt solution can feel overwhelming, but Accredited Debt Relief simplifies the search through free consultation calls. On these calls, their team of Consolidation Specialists can help you make an informed decision about your debt.

If it’s a good fit for your needs, they’ll recommend a Beyond Finance option.

How does Accredited Debt Relief make recommendations?

We’re part of the same company, so it’s fair to wonder how that affects our recommendations. Since our fees are only earned when we deliver results, Accredited Debt Relief only recommends a Beyond solution if it’s truly right for you. If it doesn’t work for you, it doesn’t work for us!

What Happens During a Free Consultation Call?

Free consultation calls with Accredited Debt Relief are designed to make debt consolidation options accessible and easy to understand.

What to expect on a call with Accredited Debt Relief:

1. Share Your Story: They’ll listen with compassion and empathy.

2. Understand Your Hardship: They’ll take time to understand your unique situation.

3. Consider Your Budget: They’ll make sure options work with what you can afford.

4. Hear Your Options: They’ll give you personalized recommendations.

5. Next Steps: They’ll offer clear guidance on how to move forward.

One Call Can Change Your Financial Future

One phone call with Accredited Debt Relief can be life-changing! In addition to helping you understand your options, they’ll take the overwhelming burden of debt off your shoulders and replace it with a sense of hope and control over your financial future.

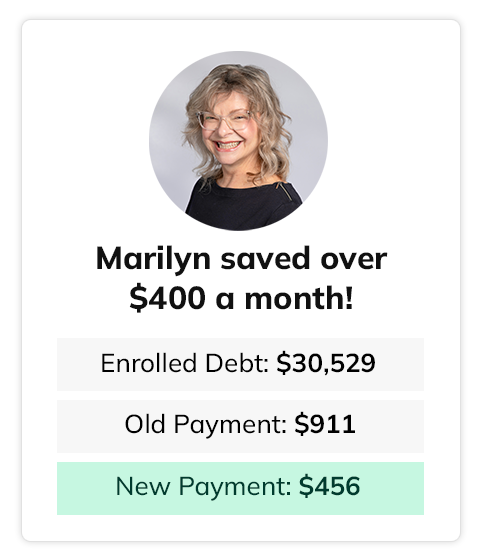

With compassionate support and a clear path forward, you’ll feel empowered to take the first step toward lasting financial freedom just like Marilyn…

My Consolidation Specialist really listened to my story and was very helpful. He made it simple for me to understand and gave me a very realistic view of the timeline of what to expect and what not to expect. It made me feel very hopeful.

Marilyn B. | A Real Client

A Personalized Approach to Debt Consolidation

Accredited Debt Relief understands that while millions of people struggle with debt, no two debt situations are exactly the same. That’s why they only match people with a Beyond Finance option if it’s a great fit for their needs and goals.

With Beyond Finance, expect:

- Lower Monthly Payments: Reduce enrolled payments by 40% or more.

- Flexibility: Payment plans that fit your budget.

- Fast Results: Become debt-free in 24 to 48 months.

- Helpful Tools: Access resources to improve money management.

- Easy Tracking: A user-friendly app to monitor progress.

- 1-on-1 Guidance: Get guidance by phone or 24/7 chat.

- Community Support: Wellness sessions to connect with others on similar journeys.

Accredited Debt Relief’s Positive Impact

Imagine going from worrying about groceries and gas to building savings and chasing big financial goals. You can break free from a lifetime of bad financial habits, stop overworking yourself to stay afloat, and finally take control of your future.

These inspiring stories from real clients show how Accredited Debt Relief has helped people in debt transform their futures.

Real clients compensated for sharing real stories. Individual results may vary.

Why Accredited Debt Relief Stands Out

Accredited Debt Relief stands out for its strong reputation and unwavering commitment to delivering outstanding service and results.

Fully Accredited: Fully accredited by ACDR and backed by years of industry experience.

Proven Results: They’ve helped 700k+ people, paying off over $2 billion debt in the process.

Award Winning: A 3x ConsumerAffairs winner for customer service, process and value.

Thousands of Accredited Debt Relief Reviews

Over the years, happy clients have written thousands of 5-star reviews expressing sincere gratitude for the guidance and support they’ve gotten from Accredited Debt Relief. Here are just a few…

Significant Monthly Savings

Mark and Dawne, Client Testimonial

Exceptional Client Support

Adriana, 5-star Trustpilot Review

Roberto, 5-star Trustpilot Review

Fast Financial Outcomes

Reddit Testimonial

Nicki, 5-star Trustpilot Review

Individual experiences may vary. Reviews are edited for length, accuracy, and clarity.

A Holistic Approach to Financial Wellness

For many of our clients, getting out of debt is just the beginning. That’s why Accredited Debt Relief and Beyond Finance go a step further, providing them with tools and resources to build financial literacy and confidence. By focusing on a holistic approach to financial wellness, we give our clients the best chance possible for positive long-term outcomes.

We take a holistic approach to financial wellness, because we believe it helps our clients achieve better long-term outcomes.

Through the Top Dollar blog, Accredited Debt Relief offers free guides and resources to help build money management skills.

Read more on the blog.

Learn More About Accredited Debt Relief

To learn more about Accredited Debt Relief, visit their website www.accrediteddebtrelief.com.

Ready to do something about your debt?

Your solution is just a phone call away. Schedule your free consultation now!