What are the Most Terrifying Credit Card Scares?

Halloween is the season of fear, so if you ask anyone at Beyond Finance, we would tell you credit card scares are the worse thing since Michael Myers.

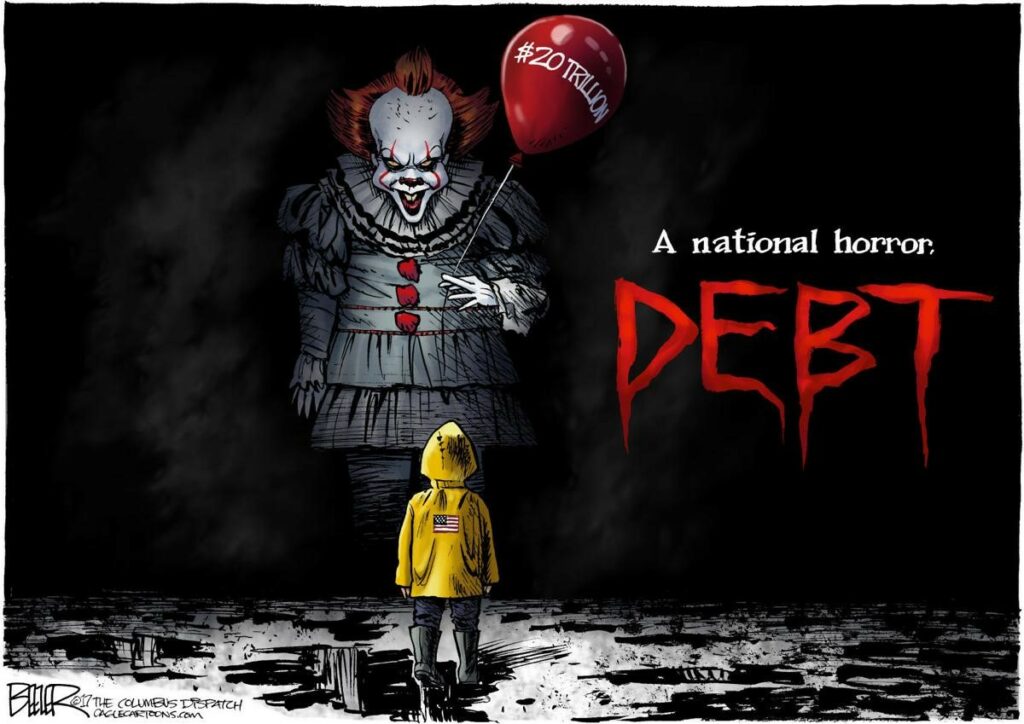

It’s the most terrifying time of the year, and not just for all the things related to Halloween. Now is when people start to think about spending more money than ever, which brings up the seasonal question – what are the biggest credit card scares?

Credit card debt is one of the most overwhelming fears Beyond Finance clients have because it has taken them to a point where they feel they have lost control and need help. While we’re prepared to support anyone overwhelmed by the burden debt can generate, we are also positioned to offer tips on preventing the fear money creates.

Take it from us. Carelessness with those plastic cards of happiness can make you see ghosts and hear evil spirits. (What you hear are the constant rings of bill collectors. We can chat about that later.)

Here are Some of the Creepiest Credit Card Scares

1. Credit cards are spooky money

Think about this: You are spending money that you do not have. Credit cards provide consumers with a line of Monopoly money—it is not yours. The money you spend is borrowed, not given. You must pay it back, which is the scary part. Eventually, the bill shows up in the mail, and that’s when you scream because you had “no clue” you spent that much.

With credit cards, you are spending fake money now for your real money later. When the bill catches up with your shopping, your payment is due with interest. That’s the real scary part without having a budget. You don’t realize how much that 24.99% can add up with your borrowed money. And when it does, you won’t even have enough money to buy candy at the store for the trick-or-treaters.

2. Killing a credit card will come back from the dead

Mastering credit card scares involves money management and understanding how to use that plastic effectively. For instance, if you have a credit card and get fearful of not paying it, you may decide to close the account. It seems like a clever idea, only it’s not.

All credit card owners have a credit utilization ratio (CUR), the sum of your card balances divided by those respective limits. If you kill one card, your CUR is out of balance, and your FICO score will be affected negatively and will pull a Walking Dead on you quickly. So, keep your card open, just don’t use it.

3. Fees will suck the life out of your credit

Most who have cards fear this credit card scare – fees! Every credit card has fees, but few people understand why they exist. From annual fees to late fees, over-limit fees to foreign transaction fees, those vampires are everywhere.

These could be the deadliest credit card scares because creditors love them. The next time you see your statement, scrutinize it and see all the fees that you pay. Use your credit card wisely and avoid fees at all costs. Buy garlic if you must scare those vampires away.

4. Credit report errors could make you howl at the moon

Did you know the Federal Trade Commission tells us one in five Americans has a glaring mistake on their credit report? What’s worse is they don’t even know it. It could cost you thousands of dollars over your lifetime.

Those fleas on your credit report are hard to catch and even harder to fix. Under the Fair Credit Reporting Act (FCRA), you have a right to an accurate account free from fleas… eh, errors. And by law, you can request a free copy of your credit report once a year. Get yours from AnnualCreditReport.com.