Opportunity Cost: Debt Resolution vs. Minimum Payments

When deciding which debt resolution option is best for you, it’s essential to compare the cost of your choices. When you compare options like making minimum payments and debt resolution, you’ll find what you stand to lose or gain when you choose one alternative over another. In finance, this comparison is called opportunity cost.

What is Opportunity Cost?

Opportunity cost compares and quantifies the financial impact of making one choice over another.

These comparisons often arise in finance and economics when trying to decide between investment options. For example, if you have a large sum of money and you leave it in a bank account instead of investing it, you have a lost opportunity cost of whatever interest you could have made investing the money.

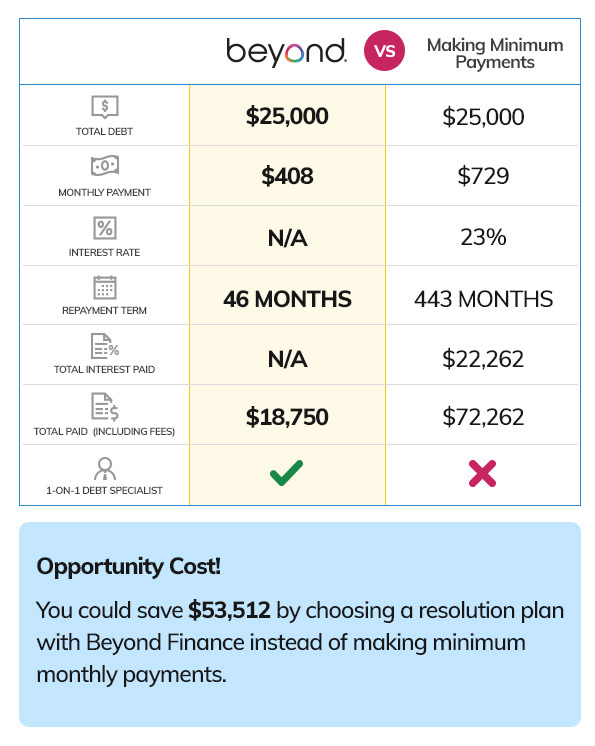

When you consider the opportunity cost of different debt repayment methods, you discover how much more you could save over time if you chose one repayment method over another. We compared debt resolution with making minimum payments to see how much you could save.

Debt Resolution vs. Making Minimum Payments

Debt Resolution:

Debt resolution programs reduce debt through debt negotiation. Typically, you enroll multiple debts and decide to delay payment to creditors until a resolution is reached.

Instead of paying the creditors directly, you make one monthly deposit into a Dedicated Account. Meanwhile, a team of Certified Debt Specialists contact your creditors and negotiate resolutions on your behalf for much less than what was originally owed.

Making Minimum Payments:

A minimum payment is an obligatory payment made on a regular schedule to remain in good standing with the creditor. The minimum amount is usually 3% of the balance on the debt and is paid monthly.

Accumulated interest and fees are deducted from the minimum payment, and the rest is used toward the principal balance.

The Downside of Making Monthly Payments

At first, minimum payments can seem manageable. However, when you look at the numbers, it’s easy to see how it keeps you in a harmful debt cycle. Making minimum payments that could double or triple what you pay for your debt over time.

Minimum monthly payments for a short period of time can help keep extra cash in your pocket when you really need it. However, relying on minimum payments long-term is not a good strategy. If you only make minimum payments, you’ll rack up interest and struggle to pay down the principal balance.

On the other hand, debt resolution can reduce the amount of money you spend on your debt. It can also speed up your repayment so that you’ll be debt-free faster.

The Opportunity Cost of Debt Resolution Programs

Debt resolution programs don’t come with added interest. Instead, they help you change the terms of your debt and lower the amount you need to repay. A team of negotiators works with your creditors directly to resolve your debts for less than you owe, including any existing interest or fees accrued. While results do vary, Beyond Finance could help you receive resolution offers that reduce debt by as much as 50%.

For example, if you owe $25,000 and make minimum payments, it could take you more than 35 years and $72,262 to pay off your debts. A resolution offer with Beyond Finance could have you debt-free in 46 months and save you $53,512 in the total amount paid, including fees!

Don’t Wait To Enroll Your Debt!

If you are struggling to repay your debt by making minimum payments, you could be missing out on a huge opportunity cost. Speak to a Certified Debt Specialist as soon as possible to find out if your debt meets the requirements for our program. Our experts can walk you through the process. We are confident we can lower your monthly payments and help you resolve your debt for a fraction of what you owe.