What are the Top Reasons People Stay in Debt?

When you speak to people struggling with their finances, you hear many reasons why people stay in debt. Although most stories have similar characteristics, they are all unique. Every person brings an inimitable vantage point of feeling trapped by debt.

- What happened?

- How did it get to this point?

- Is it possible to break the debt cycle?

- Why haven’t they been able to manage this on their own?

Most people understand how credit works—you use it, then you pay for it. Sometimes, people make payments in total. Other times, people attempt to manage over several months. It’s the honor system, but there are those unfortunate times when life gets in the way, and you can’t avoid the pothole in the road.

It could have been a financial emergency—the car breaks down, an unforeseen medical bill, or the water heater bursts. Whatever it was, you weren’t planning on it and indeed were not saving for it. Those are the times when credit helps you survive. We understand.

Some clients have joined us because for one reason or another, they stay in debt. They were committed for three to four years, made all their payments, and left with no more unsecured debt. They graduated from Beyond Finance knowing they could answer their phone again without fear and anxiety associated with debt collectors.

However, there is a possibility that could happen again unless that cycle of debt is broken. That’s what we want to discuss because you can break it or ride it again. The choice is yours, so let’s discuss how to make that choice last.

Here are the top five reasons people stay in debt.

Stop Spending; Start Saving

Many people believe they are what they own. The Joneses are everywhere, so you must keep up wherever you go, right? Of course, this is a self-imposed stressor most of the time. It’s nice to be impulsive.

You’re driving by a big box store, and you think of something you have been putting off, so what do you want to do? Park and buy it. But do you need to do that?

Would that new toy be better if it was still the fistful of dollars to put in the bank? It may not feel like it, but you should reconsider.

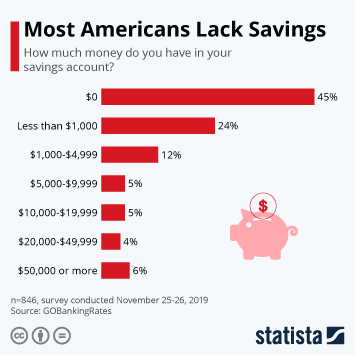

45% of Americans have zero dollars in a savings account? Only 24% have less than $1,000. Have you ever had a financial emergency, like going to the hospital or the car breaking down? It’s usually more than $1,000, so what will you do besides worry uncontrollably? If you had money in the bank that you are committed to not spending, you might have fewer gray hairs and more hours of restful sleep.

Can’t Spend or Save

Ever since the pandemic, life hasn’t been easy. Life has become much more expensive, which doesn’t help our stress levels. The problem is while every business is raising their rates to recover what they lost during COVID, you didn’t get a promotion, raise, or even a side hustle.

That’s the challenge—how can you spend a dime extra (much less, save one) when you don’t have it in the first place? It’s unfair and unfortunate if you only stay in debt, we understand. Is there freelance work you can do? Maybe you can look carefully at your bills and trim where you can? Believe us. You can do it. And, if you can’t get out of debt by yourself, we can help.

Vice or Sacrifice

The only way to get out of debt is to decide to stay out of debt. Without that choice—and then the commitment—to stop buying fast food, extra clothing, various things from a home store, or even that $9 coffee you get “for points,” you won’t have extra money.

What’s more important? That thing you usually get or the money it costs going toward a bill or in your bank? Are you willing to sacrifice, or is that vice a necessity? You know the answer. Just make a choice and stick to it. Only then will you feel good about not spending and start saving.

Ignorance is Not Bliss

How well-versed do you think you are in financial literacy? If you’re not sure, you are not alone. It’s your money, so why wouldn’t you want to know more about it and how to save it? Nonetheless, 53% of U.S. adults consider themselves “financially illiterate.” That could be the only reason some people you know stay in debt. More importantly, they don’t know what they don’t know, which causes considerable stress. There’s a real name for that—Acute Financial Stress.

And if you believe you don’t know enough, find the information. Your money is worth it. So is your security. Perhaps this is why so many Americans struggle with unsecured debt? They don’t understand how to manage it. Money problems and financial struggles do not have to be overwhelming. Education is power.

Un (or Under) Employment

If it wasn’t the recession of 2008, it was undoubtedly COVID that hurt most Americans financially. More than 22 million people lost their jobs in the first few months of the pandemic.

It’s been almost two-and-a-half years. The economy is rebounding slowly, but how’s your job situation? If you stayed employed during the pandemic, you were fortunate.

Millions of Americans found themselves without a job, so they took employment wherever possible openings could be filled–gas stations, grocery stores, warehouses, loading docks.

Currently, more than 6.5 million are unemployed people in the United States. There are also another 9.4 million who are “underemployed” or overqualified for their current job but need a paycheck.

That creates a hole in the wallet and a drain on the bank account. Focus on getting the job you deserve or the position you lost. When you get there, make yourself a promise to put money in the bank with every check, so if life happens again, you’ll be more prepared.