Red Flags for Holiday Social Media Scams

It is the most wonderful time of the year unless you are one of 258,000 people who lost a stunning total of $2.7 billion since 2021 because of holiday social media scams. According to the Federal Trade Commission (FTC), those are only the reported cases in the past two years. The concern is that the actual number is two to three times greater now at $6 to $9 billion.

Unfortunately, this is the most opportune time of the year to play on the emotions or goodwill of innocent people on their social media platforms. Aside from searching for bargains on gifts, many keep their eyes open for charitable ways to give back to their communities or the country.

Types of Social Media Scams

Social media is almost omnipresent. Using any platform is as easy as reaching into your pocket and grabbing a phone. With something so readily available to someone of most ages, there are advantages to enjoy and risks to assess. Understanding the types of social media scams helps determine the tactics.

Here is a list of five most frequent social media scams.

Romance Scams

The FTC warns anyone using a dating app to avoid falling victim to “romance scams” or schemes hosted by malicious profiles on those websites. Those profiles cover what the scammer intends to get from others–their money. They “live far away” or “can’t make it” to come over, but requests for money are made nonetheless.

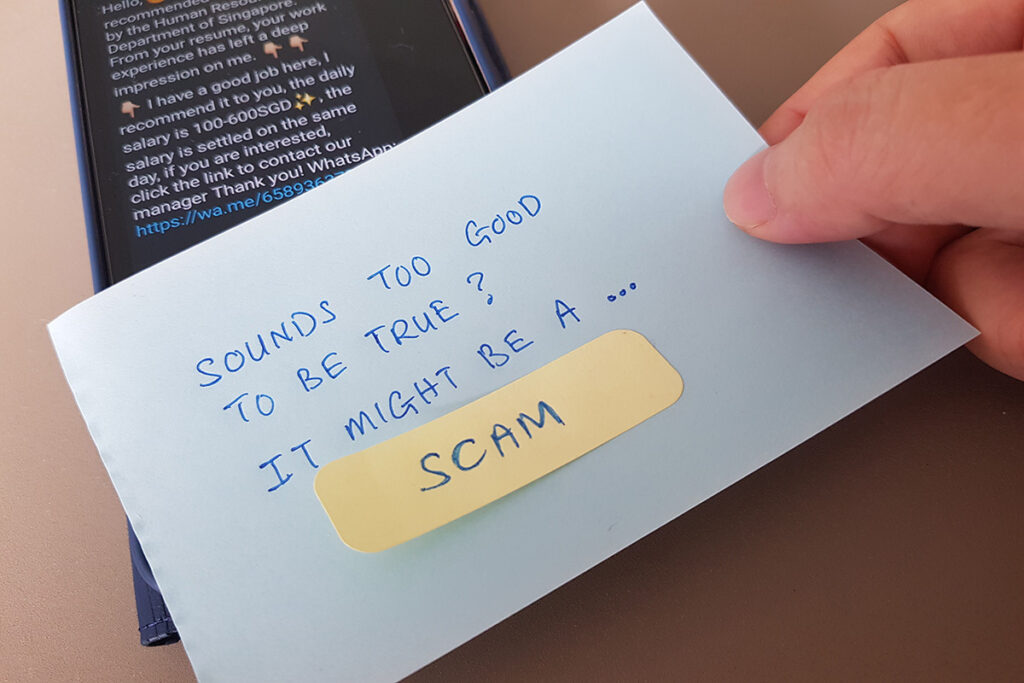

Investment Scams

A great way to begin the year would be to gain more finances, like affordable new property paid monthly. If the phrases “make lots of money” with “little to no risk,” the FTC advises to research the terms and source of the deal more. If it’s too good to be true…well, you know the rest.

Impersonation Scams

These scams come from government agencies or large corporations that ask for personal information to be filled out online. The reason is cloaked to help the consumer avoid mysterious charges or even months of imprisonment. Whether it is a money order or a gift card, the Department of Justice (DOJ) warns consumers from giving money unless there is certainty.

Employment Scams

During the height of the pandemic and unemployed Americans searching for work online, some profiles on job websites would be fake. The number of scammers was rising rapidly, and the U.S. DOJ took to social media to warn everyone what to know and how to report a scam.

Clickbait Scams

Often, hackers use FOMO–or the “fear of missing out”–in emails for unsuspecting people to click on a link and accept a virus or anonymous worm into their computer. All it takes is something like, “Don’t miss exclusive backstage pictures from the Beyonce concert!” The bad news is that the email wasn’t from a verified source.

Tactics of Social Media Scams

How can shoppers trust websites offering coupons or deals for seasonal gifts found on Facebook posts, TikTok videos, or LinkedIn messages? Beyond Finance asked its cybersecurity leaders for insight to help consumers. They listed seven red flags or warning signs to help identify and ignore holiday social media scams.

Sales Pressure

Bad users on social media use pressure to get money or personal information. Maybe you have seen the email, “I’m borrowing someone’s email since I’m locked out of my apartment, but I need $5,000 now, or I lose my property. Maybe a gift card?” Does sending a four-figure card to a strange email make sense? Probably not, so slow down and trust your instincts.

Fraudulent Links

Holiday social media scams exist because other trustful users click on links. In a hoax, a link could involve malware or a virus set to infect a computer and scrape personal information–if not, hold the computer hostage ultimately. If the link is not from a verified source, investigate the destination or don’t click.

Open-Ended Questions

“Hey, is this you?” or “Hello, how are you?” or “Have you done something like this?” are ways for dark users to appeal to people for unfortunate link clicks. Ignoring that curiosity is all the difference between not falling victim to a scam and losing an account of life savings. If a “friend” sends an overlooked link, that friend will follow up to inquire about interest.

Easy Money

Most Americans work hard for their money. Holiday social media scams promise money in return for an email, click, or small investment. In short, do nothing for money but get it anyway. There are no guaranteed returns on investment or small exchanges of information for large payouts. Life isn’t like that outside of winning the lottery or attending a game show.

Unexpected Outreach

Another bonafide sign of holiday social media scams is an email, direct message or impersonal connection demanding attention. The catch is that the brand, request, or sender has come from nowhere – like a package that ‘can’t be delivered’ or ‘problems with your account.’. Engagement is usually safe if the relationship is expected, such as an exchange for a rewards account. If not, engagement could be a huge mistake.

Poor Spelling

Regretfully, AI apps will help users with their unethical intentions. Holiday social media scams typically contain typos, misspelled words, and that “form letter” feel. Things like “Dear Client” or non-sensical greetings are red flags to warn users from becoming prey to another piece of social engineering or corrupt software.

Forceful Authority

Most people respect authority–teachers, police, or babysitters. A cloaking device for fraud could be a text or email from an authority demanding action. Something like the IRS asking you to get into your file using your social security number. They count on that respect and hope the target doesn’t think twice about would the IRS would do that in the first place. They don’t.