Throughout my years of providing financial wellness therapy for people from all walks of life, the one thing that never ceases to amaze me is how people in debt don’t understand emotional literacy. In fact, there is a serious mental health need to realize finances and emotions are connected. I’m not sure why that is surprising. The US divorce rate, the third highest in the world, is confounded by 28% of former couples citing money issues as the reason for separating.

If you asked each of those couples, “Did you ever attend financial literacy classes together,” few–if any–would say they even knew that was possible.

At Beyond Finance, we connect the dots for our clients on how essential mental health stability is when considering your finances. Anyone can cover the basics of financial management with a detailed Google search. What about how finances make you feel? More importantly, what are you supposed to do with those emotions?

Few financial services organizations have answers to those questions or offer practical tips on managing those complicated feelings. It’s easy to cover financial literacy with a downloadable PDF or a random QR code, but when you involve emotional literacy, responses must be specific and more thoughtful.

Can you change mental health issues related to their financial wellness? It begins with the answer those issues warrant. This can be a long journey for some people who experience “financial PTSD” triggers, like when a bill collector calls during dinner or when those paper bills turn pink. It begins with learning three practical tools related to responses toward your finances.

Three Emotional Literacy Tools for Your Future

When focusing on money, I’m determined to discuss emotions with my clients and the Beyond Finance clients I have counseled. If you have ever disagreed about money with your significant other, you know the topic can be emotional. So, why are we so hush-hush on the thought of emotional literacy? Not here.

The three building blocks of emotional literacy when confronting financial wellness are:

- Recognition

- Realization

- Regulation

Let’s go over those to see what I mean.

Recognition

To develop emotional literacy in dealing with your finances, you must first recognize the emotions you have connected to your finances. For example, the six primary components of financial literacy are:

- Earn

- Spend

- Save

- Borrow

- Protect

- Invest

How do you feel if you are doing one of those at any point? When you earn money, are you happy? When you spend it, do you feel regret or fear? When you borrow, does shame hit you? Does the thought of saving make you laugh cynically, or do you have a sense of accomplishment?

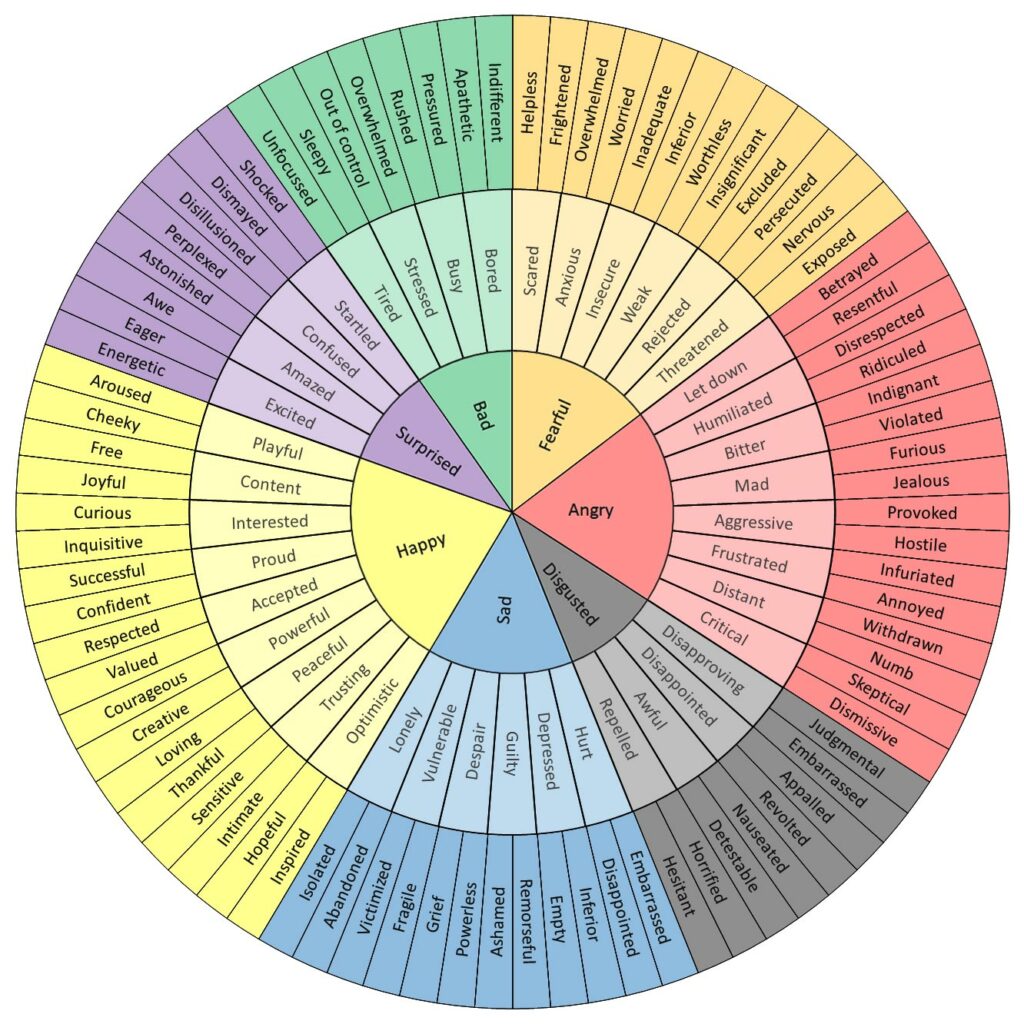

We also want to be able to label the specific emotions that come up. I often use a feelings wheel as part of that exercise. This device organizes 72 common emotions into a pie chart, aligning them in six categories: sad, mad, scared, joyful, powerful, and peaceful.

This can be useful to identify what you feel at any given moment to address those feelings for closure, resolution, or even discussion. I encourage you to start in the smallest circle and see which emotion comes closest to your senses. Now go to level 2. Here, discover if any of those words are even more authentic than the “simple” word from the center. Repeat for level 3 if applicable.

That is why acknowledging those feelings are important. Understanding how you feel as you become financially literate helps you achieve financial wellness. If not, you’ll have this void that stays unchecked, so that you may feel confused now.

Realization

You may think “recognition” and “realization” are the same, but dealing with your emotions first equips you with the strength and confidence that you will manage them eventually. It’s one thing to experience your feelings with money; it’s another to realize those emotions to cope more effectively.

In short, emotional literacy about financial wellness is understanding your feelings about money and why. If that step is never accomplished, how can you expect to earn more and feel good about it? Instead, you may hoard all the money in a savings account because you “may not earn this much again.” Of course, you will.

It’s part of a simple cyclical relationship. You know what “IQ” is–your intelligence quotient. However, there is a term psychologists and counselors have embraced lately called “EQ”–your emotional quotient. Here’s the relationship:

IQ is “know-how.” EQ is “know you.” Once you understand both, you are on your way to managing money-related emotions and improving.

Regulation

The final phase of emotional literacy is regulating or managing your feelings related to personal finances. In the first two phases, we have recognized your feelings and considered proper responses to them. But what if you have experienced some “financial trauma?”

Have you been laid off? Did you ever total your vehicle? Was your identity ever stolen? What about a divorce? Significant financial traumas could impede your success in managing those troubled emotions and your fractured relationship with money. How can you continue and make things happen moving forward if you can overcome what happened then to cause your setback?

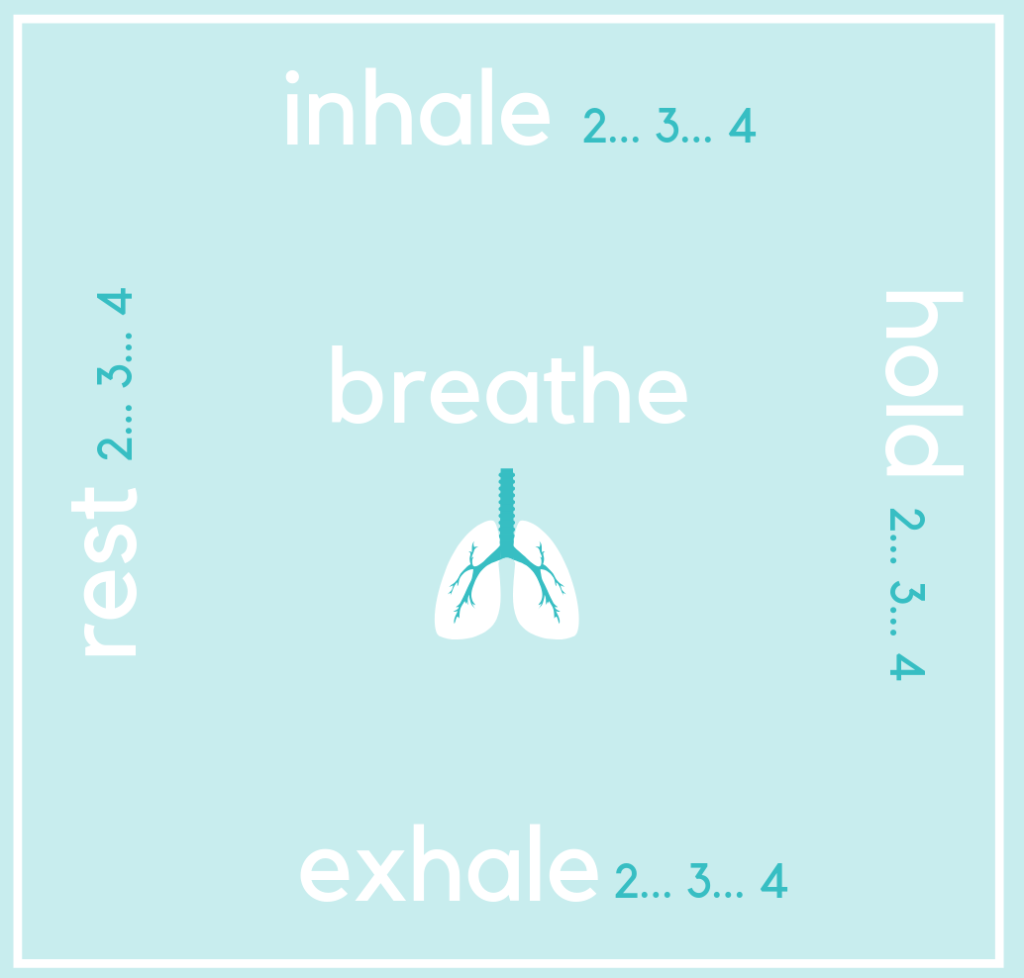

A couple of effective coping mechanisms we use for clients to overcome those feelings of stress and hopelessness are the “Box Breathing” method (or “Square Breathing”) and the 5-4-3-2-1 technique.

Thanks to helpful images like this, square breathing is simple to understand. The 54321 technique is a bit of a misnomer because it’s not about counting backward. There is a method to this technique that allows you to refocus. Pay attention to what’s important to you instead of the fear and worry you’re experiencing.

It goes like this:

- Look For 5 Things You Can See: Notice the wood grain on the desk. Is there a green plant in the corner? What about a monitor on the wall or a table? It could even be a piece of clothing or your fingernails. Take your time to acknowledge what you see.

- Note 4 Things You Can Touch: Wherever you’re at, feel. Maybe it’s the leather of your car seat or the work chair mesh. Perhaps it’s the cotton shirt against your neck or denim on your legs. Whatever you can feel, try to use that sense.

- Focus on 3 Things You Can Hear: No eavesdropping, listen. Allow the sounds to fill your mind–the distant traffic, melodic keyboards typing, voices in the next room, or the space between sounds.

- Notice 2 Things You Can Smell: If you don’t smell immediately, consider the fragrance of the air (e.g., air freshener, room spray, candles) or even your skin (e.g., soap, lotion)

- Find 1 Thing You Can Taste: Is there a remnant of your breakfast, water, or coffee resting on your palette from this morning? Use that to awaken your senses.

A calm mind is an effective place to start when struggling with anxiety or stress. Our emotional literacy is the precursor of financial wellness because our feelings take over when something happens monetarily related. Money is emotional, and it’s okay to say that out loud. It’s good to remind yourself that positive feelings about your money will create favorable circumstances.

We must become better at recognizing, realizing, regulating, and restoring our feelings with money. Emotions drive decisions. Feelings rule rationale. Get those feelings in check to finally experience the debt-free life you deserve.