One of the most significant headlines America has read this year is related to a long-debated subject and may not be what you think–student loan forgiveness.

More than 48 million current and former students are paying $1.75 trillion of provided higher education loans. Get this: That is $412 billion more than Americans pay for automobiles. If you are one of those 48 million, this got your attention. Circle November 15 on your calendar for an alert on your smartphone.

The U.S. Department of Education (US DoE) offers $10,000 – $20,000 for approved federal student loans. Borrowers have to do their part–complete an application to receive relief. And that must happen before the COVID-related payment pause extension ends on December 31.

Good news, right? But where does that leave you? It’s still uncertain.

Student loans are so ambitious because it’s about a person trying to invest in themselves. College is an institution where people choose to get educated and learn how to become productive members of society. And then, it’s like making a deal with the devil.

Millions of people every year take out student loans. Why? They don’t have other options, like wealthy parents, to pay for things. It’s unfortunate due to the amount of personal debt people take on. Go start your life, and here is a wheelbarrow full of debt.

Some clients who come to Beyond Finance hope we can help with those overwhelming student loans. Unfortunately, that is not “unsecured debt,” which means the industry can’t help with that kind of debt.

Secured debt is backed or “secured” by another person or company liable for the debt or by the item purchased, like a car or house. Unsecured debts like credit cards and medical loans are not backed by collateral or any other guarantor, just a promise to pay from the consumer.

(US News & World Report)

The U.S. government backs student loans. There is no sacrifice to your collateral if you can’t pay it. The item purchased is education, so companies like Beyond Finance and Accredited Debt Relief cannot take those amounts.

A Step in the Right Direction

Right now, student debt feels like a life sentence in some sort of prison program.

That’s why the government offering student loan forgiveness is a drop in the bucket. At least, compared to the rest of the monthly debt many Americans accumulate monthly.

On its own, $10-$20K sounds nice in the bank. What if your student loans spanning three degrees cost $225K? Millions will get that help and still have more student debt than they can pay. This is an extreme–and sad–situation that needs federal intervention.

To make matters worse, it’s a reminder that hurts. The U.S. DoE says:

- 41% of those Americans who qualify for student loan forgiveness are age 65 or older

- 32% of all borrowers have debt with no degree because they couldn’t afford to keep going to college

- 16% of people hoping for student debt forgiveness are in default with their student loan

Can you imagine getting a phone call and the person says your school loan is in default, so pay up $50,000 by Friday? Who can do that? While helping millions of Americans with student loan forgiveness is a good thing, the heated debate has made this a political issue, not a debt issue.

Following the vice grip of inflation and rising costs everywhere, Americans are still reeling from COVID-19 business. We need to consider the people paying the debt instead of the “issues” related to it.

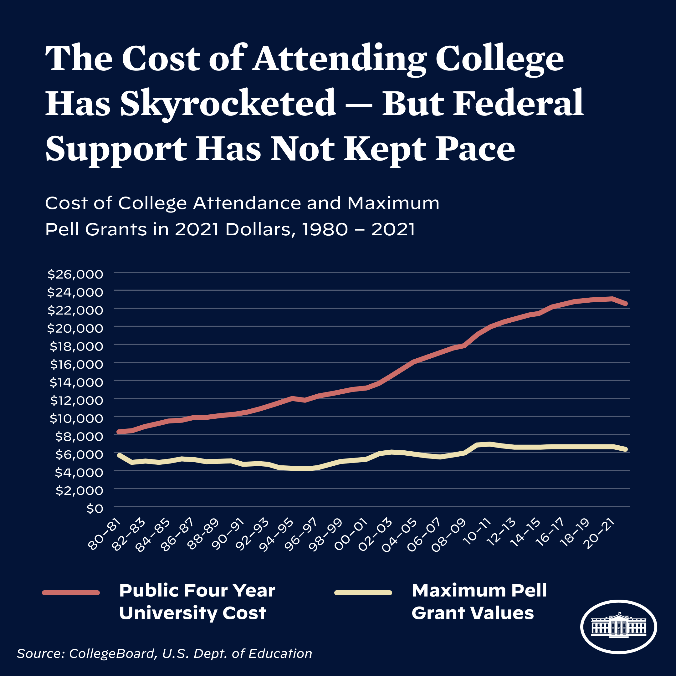

If someone lives with limited income, they can qualify for federal assistance. The DoE calls it a “Pell Grant.” It doesn’t have to be repaid but look at that other line skyrocketing.

You were given this, but the average cost of college is that. That gap is where student loan forgiveness should focus to help the rest of us.

Our dedicated client service teams frequently hear the regret from clients about our inability to help with their student debt.

You want to shout that no one in this country should feel “trapped” or “punished” in finances because they wish for higher education, but those feelings are real.

While we wait for the peace-of-mind student loan forgiveness will provide millions of former college students, there are other ways you can work on those loans. That government-allotted amount may not be enough, so let’s see what you can do.

Start Your Walk Toward Lowering Student Loans

Of course, the best way to pay down your school debt is to pay more each month, but who has that kind of money stuffed under a mattress? Moreover, the ideas below are free for our clients and anyone who asks us. Wait for the student loan forgiveness, but get started on doing something about your loans now:

Refinancing

If your credit score is fair to good (580-669 and 670-739, respectively), you could be considered for refinancing however many school loans you have and placing those into one private loan with a lower interest rate. However, that is a big “could” because not everyone can refinance student loans. The main note here is that if you refinance a student loan, you lose income-driven repayment or–wait for it–student loan forgiveness.

Reclaiming

Do you know those “unclaimed or reclaiming money” websites your state offers? Go to them! You never know what the government found that belongs to you. Another area of relocating your money is thinking twice about those unnecessary monthly bills or ‘nice to haves.’

If you don’t need them, cancel them. You won’t miss the subscriptions. From selling items you no longer use to thrift clothing stores or renting out your spare room, there are many ways to gain what you used to have.

Open up your bank account and look at it objectively. You can save considerably there.

- Subscriptions – If you don’t use them, you won’t miss them

- Phone Bill –Do you use all those features

- Food Costs – Learn to cook or be disciplined to do it more often

- Rent –Can you stomach “living like a student” a bit longer to help with your expenses

- Online Auctions – Sell stuff because there are so many places to get money

Reconsidering

Want a tip for paying a little extra on a student loan? Split your payment into two biweekly payments with a little extra on both. You can trim the fat of interest costs and fees on that student loan and begin to get ahead for the first time in a long time.

Revising

If you struggle with debt each month, consider prioritizing your creditors so you can focus on one bill at a time. Two methods to paying your debt are “debt snowball” and “debt avalanche.” Continue to pay your bills, but focus on one to pay off. And then another. Many of our clients tell us they went that route and did not spend as much each month. For more significant amounts, revise how you pay them. Investigate autopay. Many federal loan officers offer discounts for this convenience. Making that decision could save you thousands in the long run.

Reallocating

Every once in a while, you will get a gift of money from a raise or promotion on the job, a birthday from your friends, or even tax refunds. If you want some student debt forgiveness the old-fashioned way, take some windfalls and give a portion to that loan. It won’t feel as good as buying new shoes, but it will allow you to breathe more easily. Isn’t that worth it? Before you buy groceries, pay everyone else, and donate, always pay yourself first!

If you want to talk to someone about feeling overwhelmed by your debt or a free assessment of how you can get some help, join us, and we’ll work together to move you beyond debt!