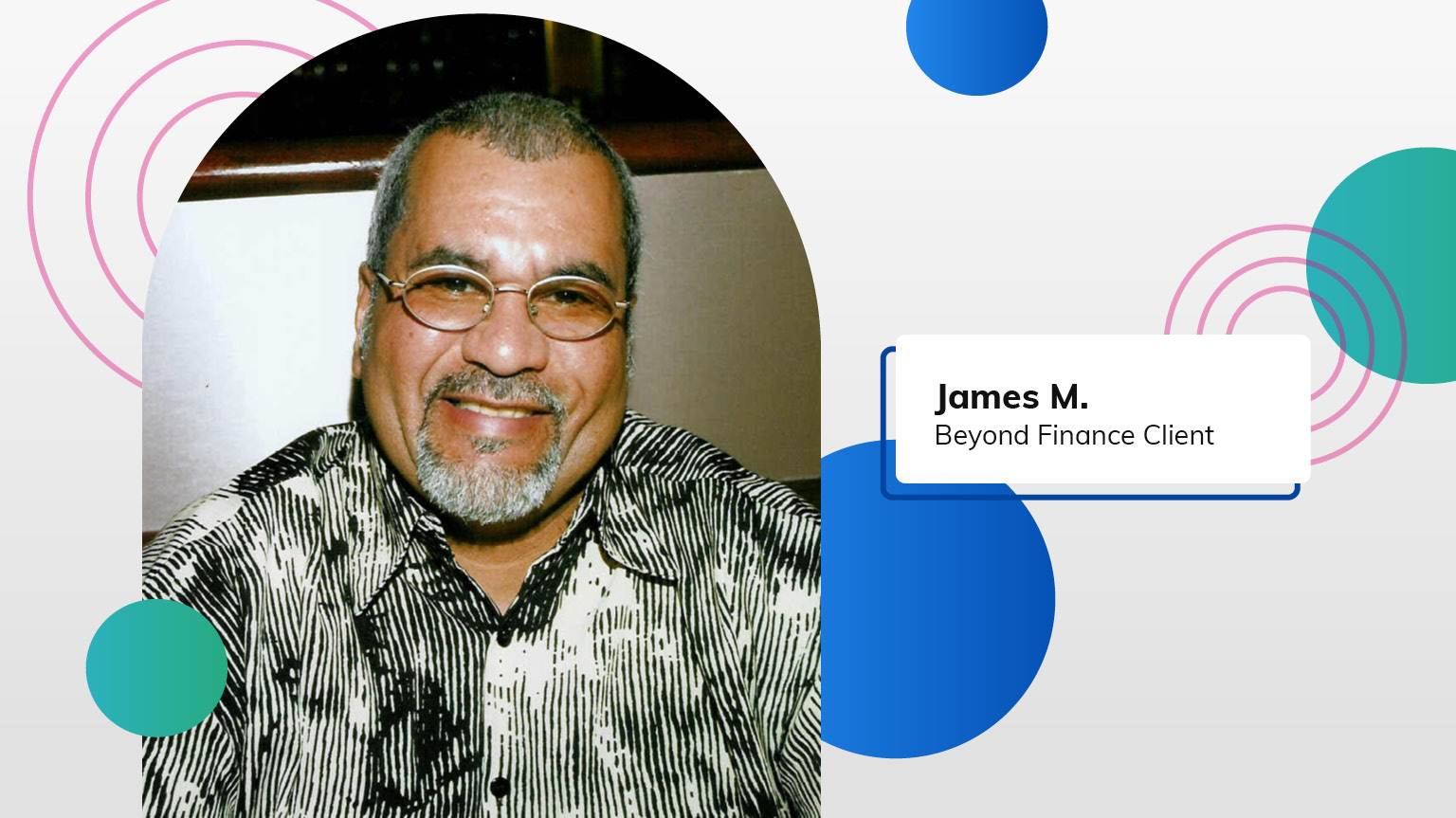

Client Exclusive: How We Helped James After His Wife’s Illness

I was in over my head. I tried to resolve it myself, but I ended up going deeper into debt. It got to the point where I had to decide between paying a bill or buying food. That was the last straw.

Debt Amount: $38,672

Started: June 2025

Savings: $947 a month!*

Meet James: A Retired Railroad Worker From Texas

After dedicating decades of hard work to Union Pacific Railroad, James M. was ready to enjoy his retirement years in Texas. But instead of peace and relaxation, he found himself overwhelmed by a growing mountain of credit card debt and a life that no longer felt manageable.

How It Started: A Budget Derailed by Life’s Challenges

When James first retired he had a solid plan that revolved around a house budget tailored to his fixed income. At the time, he reserved credit cards for what he called “fun activities.” But everything changed when his wife became ill.

Then my wife became ill, extra expenses came (meds, bills) and then I got ill too. I was just trying to maintain the standard of living I’d set, but over time, everything added up.

Extra expenses, medical bills and his own health problems overwhelmed them. They turned to credit cards to maintain the standard of living they were accustomed to. As the medical bills and day-to-day costs piled up, the stress became unbearable. The credit cards that once made life a little easier had now made it harder than ever.

Reaching His Breaking Point

James’s turning point came during a moment of painful clarity. “When I had to choose between eating and paying bills, I knew something had to change,” he said. That’s when he started listening to the people around him like friends who had faced similar challenges and come out the other side.

Through conversations with friends and doing my homework, I found Beyond Finance through the Better Business Bureau. They were rated #1 in Houston, and that gave me confidence.

Relief Through Real Conversations

Despite his eagerness to get out of debt James admits he was hesitant at first. He felt embarrassed by his debt and afraid to talk to anyone about it, especially a stranger on the phone. Ultimately, his phone call with a Consolidation Specialist quickly eased those concerns.

I felt a little afraid or embarrassed, but [my Consolidation Specialist] put me in a peaceful state just by being honest with me. She made me realize I’m not alone. She took the time to walk me through everything.

That honest connection helped James let go of shame and start focusing on solutions and a clear, step-by-step path forward.

Support That Makes a Difference

Beyond Finance’s tools and guidance became more than just resources—they became lifelines. He has benefited from client support videos and other resources in the client dashboard that give him advice when he needs it. Additionally, his monthly payments are now manageable which gives him room to breathe.

The short videos and instructions on how to handle things are a lifesaver. And being available 24 hours a day? That’s a huge plus.

Advice for Others: “You Have Nothing to Lose but Peace of Mind to Gain”

To anyone feeling trapped, embarrassed or unsure like James once did, he wants you to know that you have nothing to lose and only peace of mind to gain.

Simply stop what you’re doing and give Beyond a shot! You have nothing to lose but peace of mind to gain.

Talking to a Consolidation Specialist is free and there is no obligation. It’s just a conversation where you can have an open and honest discussion about your debt and your options.

Looking Ahead: Finding Joy in the Simple Things

Now that James is on his way out of debt he is focused on what matters most: enjoying his family, home, hobbies, and the little pleasures that were once dulled by all of his financial stress.

I just want to enjoy the simple things in life and I’d like to thank you for all that you do.

Thanks to Beyond Finance, James’s retirement no longer feels like a burden. It feels peaceful and full of possibility, just like it should.

*A quick note about Jame’s story: He’s a real client who was compensated for taking the time to share his experience with us. James saved 61% on his eligible monthly payments and his savings were calculated by subtracting his program payment from his self-reported payments or tradeline minimums on eligible accounts. On average, clients with $20,000 to $40,000 in debt save $593 on their eligible monthly payments, a reduction of 56%.