The 10 Things You Probably Didn’t Know About Your FICO Score

We’ve heard it from our clients. Even our team members scratch their heads on this one. Have you ever tried to figure out what creates a FICO score? There are many myths about what makes a credit score, which we recommend you review. With this post, we uncover some obscure facts about your FICO score.

First, let’s figure out what it is through this easy-to-understand video from the Fair Issac Corporation (FICO) that was created about the components of this mysterious formula.

What makes them the credit authority? They were the first company to offer a credit-risk formula with a score. To make things more frustrating, “Fair Issac” was Bill Fair and Earl Issac, who devised this mercurial mix in the 1950s.

And because of these number crunchers, we are all subject to this three-digit score for the rest of our lives because more than 90% of top lenders use this algebraic equation to decide if you qualify for a loan. If your credit has been damaged because of collection calls and delinquent payments, this score will determine if you can get a consolidation loan.

So, who understands why this FICO score holds all the cards? What makes it so powerful? And how do we learn how to improve it? The research all starts with understanding the foundation of these figures of creditworthiness.

Here are 10 mysterious things to know about your FICO score.

1. Five factors create your FICO score.

Surprisingly, your FICO score is not all about making payments on time (although we strongly encourage that becomes a habit for our clients). The three credit bureaus develop the reports that create this peculiar, amalgamated score – Experian, Equifax, TransUnion – pay attention to these five essential aspects of your money management to determine those three sacred digits:

- Payment History (35%)

- Card Utilization (30%)

- Credit History (15%)

- Open Credit Card Mix (10%)

- Credit Inquiries (10%)

2. Closing an account could hurt your FICO score.

It doesn’t seem right. If you close an account, you have paid it off, so that’s good. Right? Remember those five factors above discuss a credit mix and history. If you have a card but close it, you remove two of the five factors—credit mix and utilization. Pay as much as you can on the balance but leave the card open to maintain your credit history and mix, which will help your FICO score.

3. Credit “reports” are not credit “scores.”

They both start with the word “credit,” and after that, differences abound. A credit report is an itemized list of your credit cards and history of payments. It’s a report without subjection. So why a “credit score”? Because a FICO score is not provided on a report for security purposes. What’s in the “report” determines your “score.”

4. Credit cards are not cell phones

Cell phones make their money by creating new models every year. FOMO (fear of missing out) sets in across the country. Suddenly, crowds of people rush to the local cell phone provider to get the latest model. Credit cards do not work that way. The longer you keep a credit card, the better your FICO score. If you don’t like the way it looks, put it in the back of your wallet. You’ll be better off that way.

5. Almost 30% of Americans don’t have a credit card

That’s true, and if you are reading this blog post, you should not be one of them. If you are considering building your credit and increasing your FICO score, you need credit cards to do it.

It makes sense that if you don’t have a credit card, you don’t have to worry about abusing one. However, if you are interested in buying a car or renting a house, you need a credit score. We have graduates who understand why you need credit but how to manage it. You can too.

6. Your education has nothing to do with your credit score

Nearly 92 million Americans (42% of the country) have a college degree. And you know what? That has nothing to do with your FICO score. For some reason, there is a myth that if you go to college, you are given a better score. The only thing that matters to the FICO authority is how you manage your money. Although if you passed college algebra, you might be able to crack the code on how FICO scores happen.

7. Have it, enjoy it, but don’t use it

One of those five factors of the FICO score is credit utilization. Think of your credit cards like throw pillows. They hoard room on the couch or the bed, because…they look lovely? All those uncomfortable pillows are there to gawk at and impress the neighbors anyway. Like those “nice towels.” (If you’re married, you know.)

Credit cards are those nice towels or throw pillows. Have them, enjoy the available credit limit you have, but only use them for things you can pay off at the end of the month. For example, if you have a credit card with a $2,000 credit limit and use $1,500 of it, that’s a 75% credit utilization ratio. The three bureaus say a 30% ratio shows responsibility. Work on that.

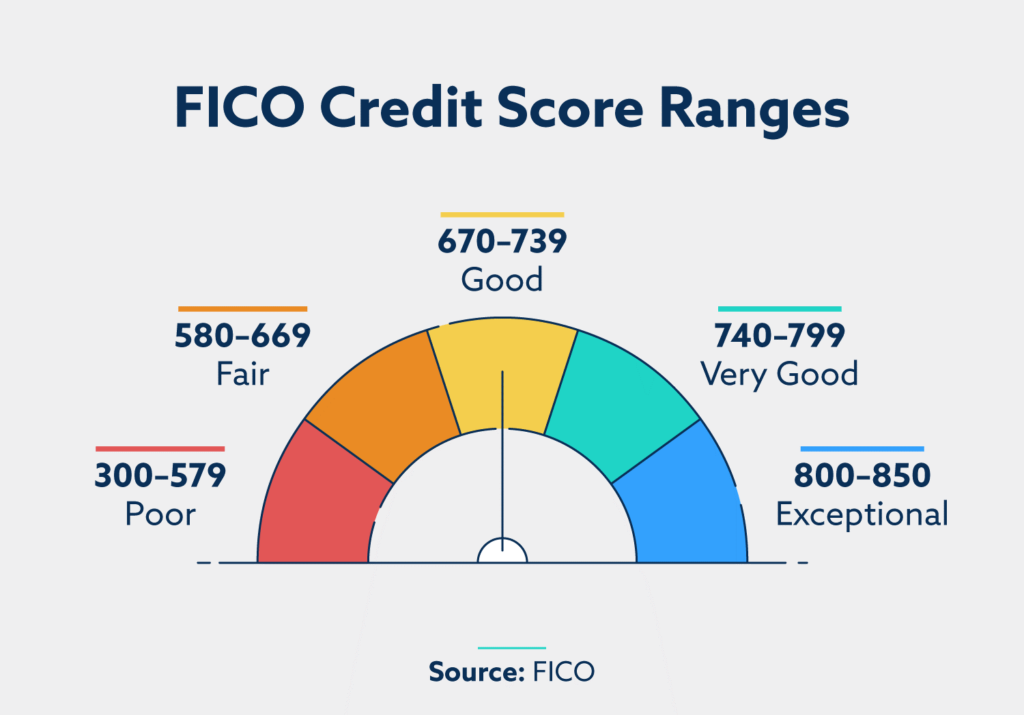

8. FICO scores have a 550-point range scale

Where you find yourself in that range can be the difference between having a banker congratulate you for being approved with a loan or telling you there is no hope, and you may want to consider other options. (And to be honest, “other options” begin here because everyone deserves a chance to get ahead.)

9. Unpaid parking tickets could affect your FICO score

True. You may be all too familiar with this scenario. You’re in a rush because you overslept. There is no available (and accessible) parking spots downtown, so you pull in front of a meter. You’re out of change but risk it anyway. The meeting is only 30 minutes so it’s a safe gamble. Much to your pleasure, the session ends early, so you rush downstairs, and there it is—that ugly yellow parking ticket.

You’re mad, so you shove the parking ticket into your glove compartment. The problem is you forgot it was there. Two months later, you hear from a collection agency. Yes, police departments are well within their right to report unpaid tickets to collections, which will bruise your credit report. The moral of the story? Leave earlier from home.

10. Your score could predict how long you’ll be married

Yes, many marriages are destroyed because of arguments revolving around money—48%. But what about before you get married? Credit scores can help tell the future. Someone at the U.S. Federal Reserve considered this issue and conducted a national survey.

The Reserve followed married couples for 15 years to see “how credit scores affected those in committed relationships.” The study discovered “the initial match quality of credit scores is strongly predictive of relationship outcomes in that couples with larger score gaps at the beginning of their relationship are more likely to subsequently separate.”

Yes, money can create problems before you even know they are there. Learn to manage those funds today. We can help with that too.