How Richard P. Found Relief With Beyond Finance

A recent study revealed that American collections agencies held $140 billion in unpaid medical bills. Considering the current health crisis and teetering job market, these debts are expected to climb even higher.

Richard P., a Texan who fell into debt a few years ago after a medical emergency, was struggling to stay afloat. Fortunately, he was able to regain control of his finances with the help of a customized debt resolution program. Now, he’s putting his debts behind him while benefiting from a consolidated, lower monthly payment. We sat down with Richard to hear more about his debt resolution journey and his experiences with Beyond Finance.

“Everything was working out, then boom — the bottom fell out.”

In 2015, Richard and his wife, who are both educators, were doing fairly well financially. Suddenly, his wife was diagnosed with a major illness, which led to her early retirement. Down a source of income, Richard and his wife then started to receive the medical bills.

“Everything was working out, then boom — the bottom fell out,” Richard explained. “We had insurance, but insurance did not cover 20% of $25,000. That’s what we would have had to pay, and that got really expensive.”

While Richard was able to manage his monthly payments with the help of his teaching salary, changes in his school district resulted in the loss of his job. The looming pressure of significant medical debt grew, and Richard turned to his IRA savings to help make ends meet. Unfortunately, there wasn’t enough to keep them afloat for long.

“It got to the point where I was getting less and less money to be able to pay expenses,” he recalled. “Then I made the fatal error of trying to use credit cards to help me through this, and that’s what really sunk me. It got to the point where we were swamped.”

“We didn’t want to lose the cars or house.”

Richard explored other debt help options before partnering with Beyond Finance, but he was struggling to find fair, trustworthy options that fit his needs.

“We were looking into the possibility of bankruptcy, but we didn’t want to lose the cars or the house,” he explained. “I made arrangements myself for some of my creditors, but others were still demanding full payment. I couldn’t even make the minimum payment.”

Richard also attempted to work with a financial relief company, but ultimately didn’t have success. “They promised a lot and they did not deliver anything,” he noted. “That got me a little frustrated.”

“I’d never done anything like this before.”

Richard eventually came across Beyond Finance while looking for debt help online, but he researched everything he could about the company before making his first move. “I compared, I checked out testimonials, and I checked out everything I could check out,” he said.

Satisfied with what he read on review sites, he then made the call.

“I spoke with somebody and gave them a low-down on what my situation was, and they assured me they could connect me with someone in the company who could help me out,” Richard recalled. “They basically set it all up. It had to have been a good feeling, otherwise I wouldn’t have continued.”

When asked what made him decide to choose Beyond Finance over other debt solution companies, Richard says it was the company’s honesty. For example, of the six outstanding bills he asked for help with, Beyond Finance’s Client Success Team identified four that they were confident they could resolve as part of a custom debt resolution program.

“It was a gamble because I’d never done anything like this before,” Richard explained. “It’s like, I am going to have to put my trust in this company because I think that’s what’s best for us.”

“Any time I’ve called, they’ve been helpful.”

When a new client joins Beyond Finance, members of the Client Success Team lead them through an onboarding process, answering questions and ensuring they understand how to access their online Client Dashboard. Richard shared that the team was patient and quick to help when he had trouble logging into his Client Dashboard the first few times.

“I probably pestered them to death until I got it figured out, but they were cool every time,” he noted. “Any time I’ve called, they’ve been helpful; I’ve never had a bad experience on the phone with them.”

After receiving login support, Richard bookmarked the Client Dashboard on his browser for easy access.

“Once I understood how to get into the website and check my account, it was a piece of cake, Richard said. “I can go to it any day at any time. It tells me where I am, what I’ve paid, and how much is left before my program is over.”

The Client Success Team also provided Richard with additional tools to help make the debt resolution process easier.

“I felt pretty confident,” he recalled about his onboarding process. “Any time I received any kind of communication, Beyond Finance said to send it to them. After I sent the letter to everybody, there were maybe one or two times someone sent me a letter about an account. I sent all of that stuff to Beyond Finance, and I haven’t really worried about it.”

“It all fell into place.”

Most Beyond Finance clients receive their first Resolution Offer within four to six months of starting their program. When Richard received his first offer, he and his wife were incredibly excited.

“Another load was lifted,” he recalled. “We were really pleased to get that. That first one took a while, but then all of the sudden, “bang, bang, bang.” I got two or three, one after the other. It all fell into place.”

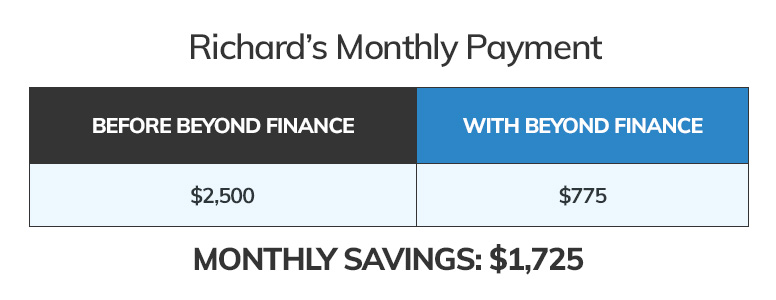

Looking at the numbers, Beyond Finance was able to reduce Richard’s monthly debt payments significantly.

“Just on credit cards and the personal loan alone, I used to pay around $2,500 a month,” he explained, noting that he was able to keep up with his old payments before losing his job. Now, Richard makes a monthly deposit of about $775, which is nearly a third of what he paid before.

According to Richard, one of the greatest benefits to the Beyond Finance program is that he hasn’t had to worry about making multiple monthly payments to separate accounts. Instead, Richard makes a single monthly deposit into a FDIC-insured bank account that he controls. Once Beyond Finance secures new terms with his creditors and Richard approves them, funds from his account are sent to those creditors.

“One payment is going to all,” he explained. “It’s kind of a one-stop thing.”

“I had no idea it could be done!”

Richard is still working through his program, but he’s made significant progress. As of writing this article, Beyond Finance has helped Richard resolve and pay off all of his enrolled credit card debt. He still has one personal loan left to go, but Richard is able to see the light at the end of the tunnel while enjoying the savings he has now.

“I’m surprised with how much Beyond Finance was able to reduce my debt,” said Richard. “I had no idea that it could be done!”

“Beyond Finance just felt right.”

When asked what he would say to someone who’s considering starting their own Beyond Finance program, Richard says it’s important to think through all of your options.

“We were a little hesitant too,” he admits. “We had to consider in our hearts what we felt would be the best company. We looked at a few, and Beyond Finance just felt right. You need to consider all of your options. What are the pluses, what are the minuses? What fits you financially?”

Richard also recommends talking openly with specialists about your finances so you can get a clear picture of what they can offer.

“You’ve got to let them know what you’re in, and then they can give you an estimate of what it’s going to cost you monthly,” he explained. “If you feel like that’s fair and you can afford it, then maybe that’s the company for you. You’ll feel that sense of relief when you feel like you’ve made the right decision.”

Richard was provided with a gift card in exchange for his time and for sharing his honest opinions about his Beyond Finance experience.