The Importance of On-Time and In-Full Deposits in Your Beyond Finance Program

While an adjustment to your deposit schedule may be necessary if life throws you a curveball, it’s best to avoid these changes if possible.

Read on to learn the potential negative consequences of missing or lowering deposits during your program.

The Negative Effects of Lowering or Skipping Deposits

While increasing your deposits or adding extra funds can speed up progress, lowering or skipping deposits can have detrimental effects to your program.

Puts Resolution Offers at Risk

If you have active Resolution Offers, lowering your deposit can put these at risk because there may not be enough funds to make payments towards these accounts. Creditors can and often do back out of previously negotiated offers if you break the terms of the agreement.

Even if you don’t have any active Resolution Offers, missing or lowering your deposits can delay future offers.

Harms Your Eligibility for the Above Graduation Loan

While missing or reducing a deposit will not make you ineligible for the loan forever, it can set you back and delay an invitation to apply until you do have a consistent stretch of on-time, in-full deposits.

Delays Your Program Graduation

Your program timeline may not hold up if you skip or decrease your deposits. Putting less money in your account will likely delay your graduation and keep you paying down the debt for a longer period of time.

What if Adjusting Deposits Is Necessary?

While it’s true that changing your deposit schedule can negatively impact aspects of your program, sometimes this can’t be avoided.

If your car breaks down, you might need the funds (that would otherwise go to your deposit), to pay for the repairs. This is why we do offer flexibility in the event that something like this comes up.

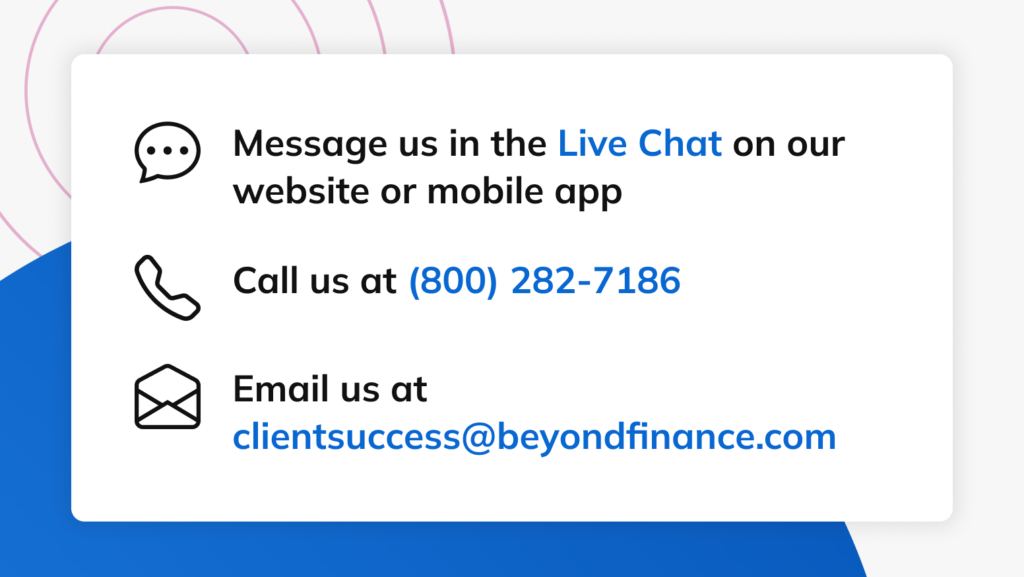

If it does, contact us through one of the following ways:

Be sure to reach out at least five business days before your deposit date so that we can pause any scheduled electronic withdrawals in time.

Note: Our Client Success team will always alert you to the potential negative effects before you change your deposits. Know that they’re not trying to shame you or make you feel bad — it’s their job to ensure you know all the facts before you make changes!

Final Words – Your Beyond Finance Deposits

Your lowered and consolidated payments can help you afford the necessities and even help you save!

And while you should always do your very best to stay on track with your deposit schedule, if something unexpected happens, our team is willing to be flexible.

We’ll work to make sure you can afford your expenses and that your program continues to run as smoothly as possible, moving you ever closer to that debt-free future.