Back To School: A College Student’s Quick Guide to Credit Card Literacy

Credit card literacy often does not take place with college students until it is too late. Credit cards can be a great asset for college students and, when used properly, they can be resourceful for emergencies or essentials and establishing credit. College students must realize the habits they set now with credit cards and finances will become the habits that carry them through adulthood.

Beyond Finance wants to do its part to ensure young adults and college students have as much knowledge about finances and credit card literacy as possible. We broke down some significant points of confusion and created the ultimate back-to-school quick guide.

The 3 Credit Bureaus

Before we can talk about credit card literacy, we need to establish a clear understanding of the three credit bureaus–TransUnion, Equifax and Experian–whose variable scores make up your FICO® Score.

Some significant purchases that could require a review of your credit report will go through one of the three bureaus. It is important to monitor your credit and look for discrepancies. Utilizing your credit reports also helps prevent and alert you of possible fraud.

You can even “freeze” your credit until you determine if there is a threat. Your report will include personal information, such as identification information, payment histories/statuses, names of creditors, credit inquiries, liens and bankruptcies.

Under the Fair Credit Reporting Act, you’re entitled to one free credit report every year from each of the main credit bureaus. You can access these reports for free at annualcreditreport.com, which is authorized by federal law.

There are several tools to help you understand what to expect from your credit report. Take advantage of being able to see updates on your credit. Set goals of the tasks needed to help increase your score.

Card Limit and Usage Percentage

A card limit places a cap on the amount of credit approved to spend by the creditor. This amount is usually higher than what you need.

A point of credit card literacy that is essential to understand-just because an approved amount appears, doesn’t mean spend more. Your credit utilization ratio is the amount that you should aim to not spend over, no matter your limit.

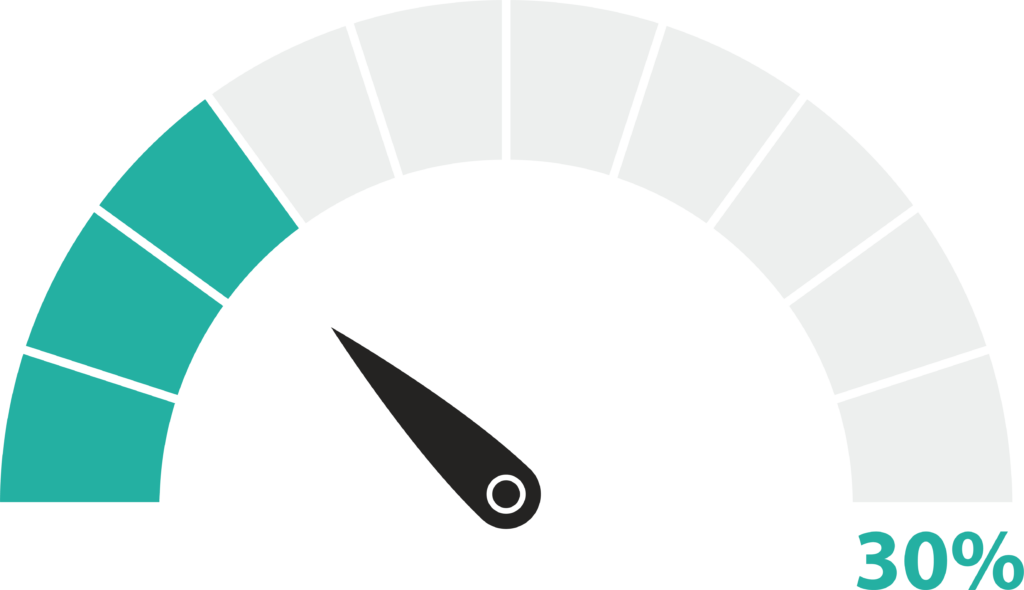

A rule of thumb is to avoid spending more than 30% of your credit limit to best help your credit score.

Good Practices for Credit Card Literacy

Finding what works best for you and your budget is a process. It takes time and practice to make these insights part of your routine. But before you do, here are a few helpful tips to consider when discussing credit card literacy:

Try to Pay Balance in Full Each Month

Spending the money is easy but paying off that balance can be a struggle without discipline. It is important to not create high balance amounts for each new statement period. Paying off the balance each month should be a priority, or at least up to 70%.

Is the Purchase a Need or a Want

While it is nice to be able to splurge on certain occasions, it’s important to prioritize your spending. You should always have enough to cover emergency situations.

For example, starting a class and having to pay for books. You do not get paid until the following Friday but need the course materials for an assignment due before payday.

If you do not have any other options, having a credit card would help supply a legitimate need. Then, pay it off on your payday.

Pay Over the Minimum Payment

Only paying the minimum payment each month will prolong paying off your balance. However, if that is all you can afford make sure it is paid on time. Avoiding your monthly payment or paying it later will result in more fees and a possible negative effect on your credit.

PRO TIP: Make payments based on the statement closing date rather than the due date. Any balance owed on the monthly statement gets reported to credit card bureaus.

Balance is Key

Credit cards do not have to be the enemy. The key to maintaining a healthy relationship with credit cards is balance.

You have to set personal boundaries of what you will and won’t spend, or dedicate certain cards to specific purposes. Although circumstances arise and do not leave many other options, dedication to your financial goals helps.

Pay off what you owe as soon as you can. Reflect on choices you can make in the future to prevent a high balance on your credit card.

Remember, credit cards should function as a support tool, not a hindrance to your future. Spend wisely and always make it a point to pay what you owe.

Back-to-school time and the cost associated with that can be stressful but bills piling up can be more stressful. Credit card literacy is important because it helps you achieve that balance for a better future.