Learning Good Financial Habits

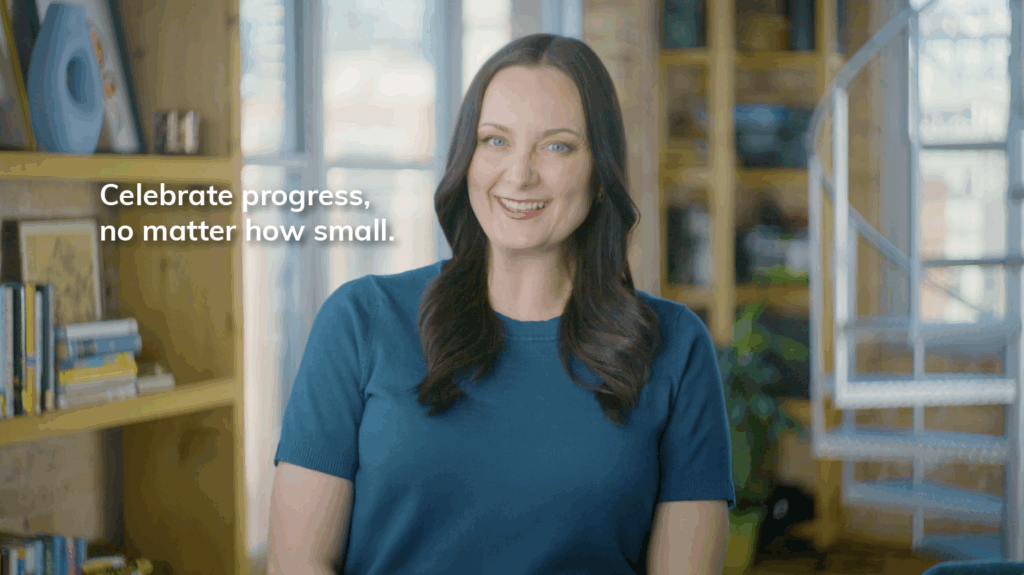

You have the power to change your habits—and it starts with one intentional choice at a time.

Way to go! You’ve already taken the first small step to better financial habits by landing on this page.

There are many ways to start improving these habits, whether it’s …

- Curbing impulse buying,

- Learning to save and budget,

- Or understanding how your emotions are informing your financial behaviors

We suggest starting with one small goal at a time.

Trying to entirely change the way you approach your money overnight is not a realistic target, and will lead to quick burn-out.

Figure out one thing you want to address first, and once you’ve been able to consistently practice this new healthy habit, pick your next small goal!

Check out the resources in the content library below and decide where you’d like to start.

Our Top Recommended Resources

Interactive Personal Finance Guide

We’ve created an interactive personal finance guide so you can see where you are, make a budget, learn your debt-fighting options, and more.

Holiday Spending: How To Be More Intentional

Learn why it’s so important to plan ahead, have conversations before holiday spending, and why sometimes saying ‘no’ is an act of self-care.

How To Trust Yourself After Financial Setbacks

Financial trust isn’t about never making mistakes again. It’s about knowing you can recover when you do.

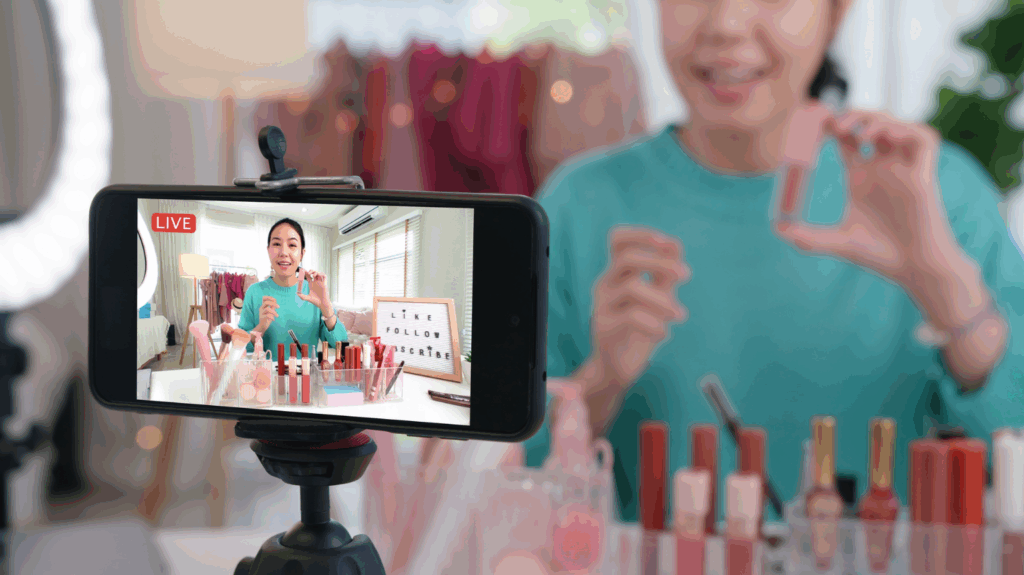

Is Your Social Media Habit Costing You More Than You Think?

In the beginning, social media was a place to people-watch, interact and reconnect. But that initial premise was soon infused with money — and now, 70% of all active Instagram users shop on the platform. That means that using social media is no longer just a way to burn time…

Tech Microboundaries & Your Money

In one of our recent client Financial Wellness sessions, our financial therapists, Dr. Erika Rasure and Nathan Astle, shared how small, intentional “tech microboundaries” can protect both your peace of mind (and your wallet!).

Money and Your Future Self

Our own Dr. Erika Rasure and Nathan Astle share how envisioning your future self’s success can lead to real positive change.

How to Stop Financial Avoidance Without Spiraling

Here’s a step-by-step plan to break out of your financial avoidance and face your finances without sending yourself into a panic.

Mindful Money Practices: Simple Ways to Slow Down, Soothe Your Nervous System, and Spend with Intention

Dr. Erika Rasure and Nathan Astle share a series of mindfulness practices that can help when it comes to money stress.

Video: Building & Sticking to Financial Goals

Financial goals don’t have to be intimidating! In this short video, Dr. Erika shares 3 tips to build and follow through on your money goals!

Video: Overcoming Overspending

Beyond Finance’s Certified Financial Therapist, Nathan Astle, explains why we overspend, and shares the secrets to curbing this behavior.