Video: Setting Financial Boundaries

Discover why boundaries actually protect relationships, how to identify what boundaries you might want to put in place, and how to approach those conversations.

Discover why boundaries actually protect relationships, how to identify what boundaries you might want to put in place, and how to approach those conversations.

Beyond Finance’s Nathan Astle shares how our ideas about money are shaped, and how to challenge any beliefs or habits that are holding us back.

Dr. Erika discusses the importance of letting one or more loved ones in when it comes to your debt, and how to have that conversation.

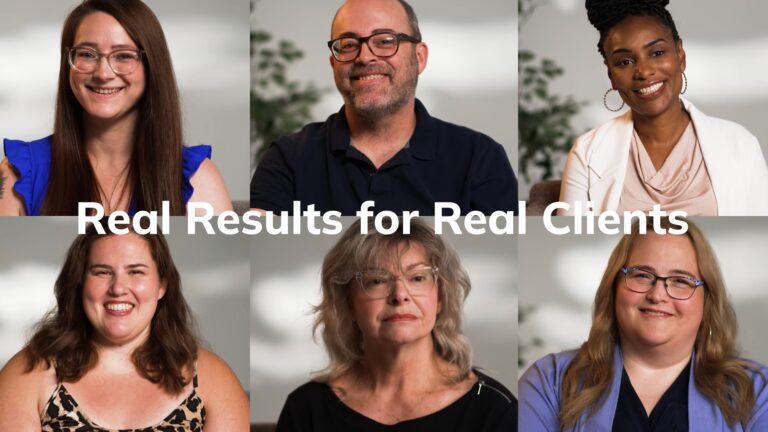

In this short video, hear from six real Beyond Finance clients about how they overcame their debt struggles so they could focus on what really matters — leading happy and healthy lives and spending time with their families and friends.

Dr. Erika explains important things to think about when starting to budget, and three different types of budgeting to try.

In this 2-minute video, Beyond Finance’s Certified Financial Therapist Nathan Astle shares two helpful techniques to manage the stress of debt and bring you back to a place of groundedness.

Dr. Erika Rasure, Beyond Finance’s Chief Financial Wellness Officer and Financial Therapist, explains the link between debt and mental health, and how to combat the stress of debt.

Nathan Astle, Beyond Finance’s Certified Financial Therapist, discusses the financial pressures men face, and how they can regain control of their finances and wellness.