Experts Agree That Americans in Debt Can Still Use a Financial Advisor

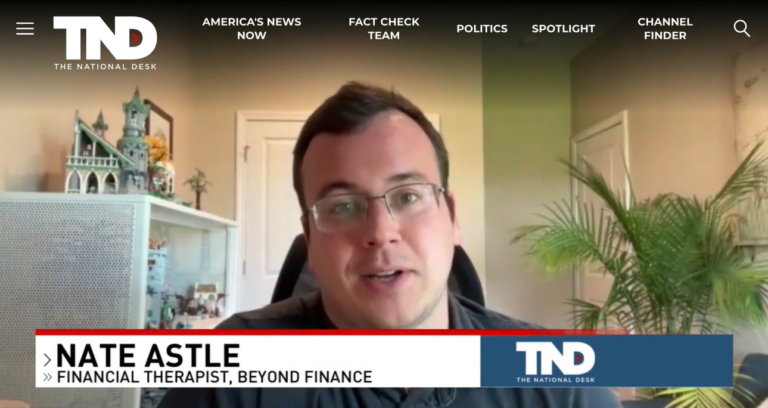

Can you use a financial advisor if you are “in debt”? Beyond Finance client financial therapist Nathan Astle believes so. Here’s why.

Can you use a financial advisor if you are “in debt”? Beyond Finance client financial therapist Nathan Astle believes so. Here’s why.

Most parents will face economic support for adult children, or “financial scaffolding.” Is it good for the family? Our Nathan Astle explains.

A summer budget is as essential as travel plans and suntan lotion when things heat up. Dr. Erika explains its importance in this interview.

The debt experience in America is more like a roller coaster than a road trip. Nathan Astle attempts to redefine it in his latest article.

“BestLife” is a U.S. publication helping American reach wellness on every level, including financial, as our Dr. Erika shares about budgeting

Everyone is being affected by inflation. Middle-class households are feeling the pinch even at the grocery store, as Dr. Erika shares.

This month’s “Psychology Today” column from Nathan Astle, CFT-I, explores the stressors and solutions behind financial secrets in couples.

Beyond Finance chief financial wellness advisor, Dr. Erika Rasure, spoke to U.S. News & World Report about managing debt collections.

With the rising cost of buying anything people are keeping their cars as long as they can. Even our client financial therapist, Nathan Astle.

Introducing the first of many monthly submissions from our Nathan Astle in “Psychology Today.” This one about “The Emotional Side of Money.”