Understanding the Human Side of Money: Bridging Emotional Evidence with Financial Intelligence

Money is not just about numbers; it’s about the emotions attached to it. This is what our Nathan Astle, CFT-I, calls the human side of money.

Money is not just about numbers; it’s about the emotions attached to it. This is what our Nathan Astle, CFT-I, calls the human side of money.

It’s been said that “Common sense is not that common.” As it pertains to credit cards, GoBankingRates.com found that to be true.

Following Financial Practice Week, Beyond Finance continues to advocate its premise–the mental health of consumers related to money.

Americans fear retirement, but there are reasons to take action for savings. ConsumerAffairs share Beyond Finance research to discuss a plan.

The 22nd American Business Awards recognized Beyond Finance with a coveted Silver Stevie® Award for “Achievement in Finance.”

GoBankingRates.com called national leaders to share their insights about financial literacy and the “Buy Now, Pay Later” trend in America.

The first-ever Financial Practice Week was a huge success with the media and consumers learning the importance of placing good measures to the test.

As Beyond Finance embarks on its inaugural “Financial Practice Week,” we commissioned a U.S. poll proving America could use more practice.

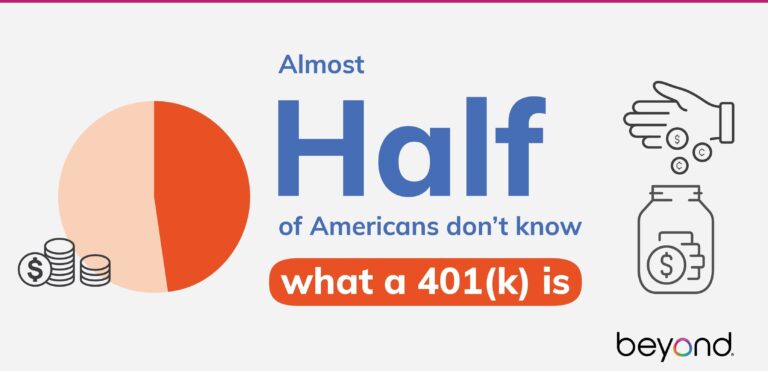

As Financial Practice Week nears, Beyond Finance found nearly half of U.S. adults don’t know what a 401(k) is. Our Dr. Erika Rasure explains.

It’s that time of the year to try spring cleaning, but for your finances. And if you’ve never done that, our Dr. Erika has some tips for financial practice.