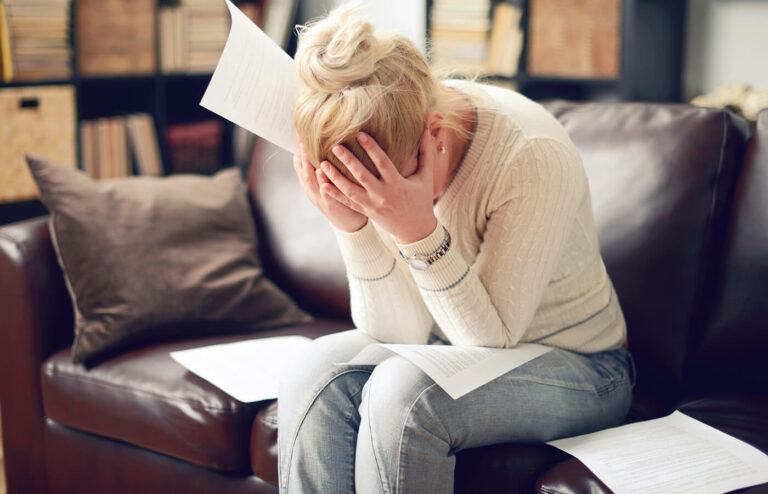

Beyond Finance Continues Advocacy for Mental Health Awareness Month: Bridging Financial Wellness and Mental Health Betterness

Following Financial Practice Week, Beyond Finance continues to advocate its premise–the mental health of consumers related to money.