The Emotional Side of Money and the Harmful Way of Moralizing It

Introducing the first of many monthly submissions from our Nathan Astle in “Psychology Today.” This one about “The Emotional Side of Money.”

Introducing the first of many monthly submissions from our Nathan Astle in “Psychology Today.” This one about “The Emotional Side of Money.”

Following Financial Practice Week, Beyond Finance continues to advocate its premise–the mental health of consumers related to money.

Stress-proofing your marriage may sound like an impossible feat but according to a recent study from Dr. Galen Buckwalter, you can do it!

If there is a conversation about debt consolidation services and credit card payoffs, Beyond Finance is ready to speak. Then, CNET called.

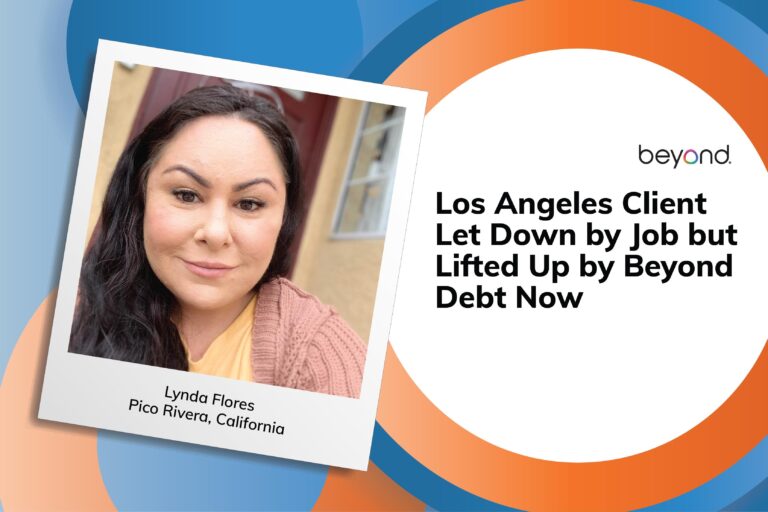

Meet Lynda from Los Angeles, this month’s recipient of the Beyond Debt Now giveaway!

Recently, AFCPE asked our Dr. Erika Rasure to be a guest on their “Real Money, Real Experts” podcast.

Beyond Finance, one of the nation’s premiere debt help leaders, seeks to establish “Financial Practice Week” to complete “Financial Literacy Month.”

Nathan Astle is a Beyond Finance financial therapist who believes one thing is missing from financial wellness therapy–emotional literacy.

One of Beyond Finance’s client counselors is helping his peers teach others about doubt with the Financial Therapy Clinical Institute

Nathan Astle is a leader in the field of financial therapy to help clients’ mental health with money, which is why he won this from the FTA.